Then deflation began, market demand slackened, and a deep recession set in.

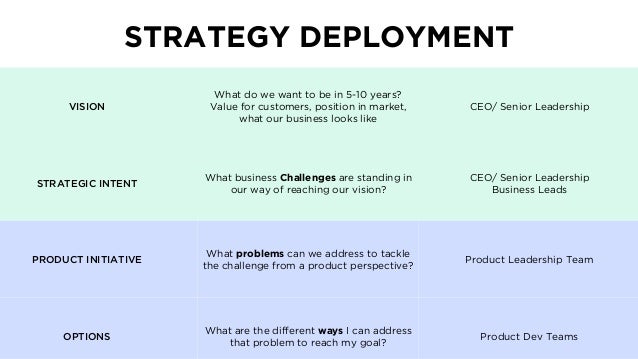

Business Strategy vs Product Strategy

XYZ was caught squarely in a competitive pricing trap. To catch up, they considered investment to modernize existing facilities or to build new cost-competitive plants. But the capital investment costs for such construction were so high that XYZ could expect to earn an attractive return on its investment only by selling products at prices well above the going level—prices that its rivals could continue to undercut.

Many U. Once a secure geographic monopoly—and essentially a commodity business—the electric utility industry is now in the throes of price warfare in the wholesale and bulk power market segments, with low-cost producers in a position to take business away from higher-cost suppliers.

Nearly every electric utility that is constructing nuclear power stations to meet future generating needs is being squeezed by escalating capital costs and a market place replete with generating capacity. A number of power companies, increasing generating capacity at capital costs three to five times higher than those for facilities brought on in the s, are nervous about whether the high fixed-cost charges for these new facilities will allow them to be price competitive with other electric energy suppliers.

New Product Strategy - Monash Business School

The future holds even more competitive pricing threats; a potential breakthrough in the development of solar thermal equipment and photovoltaic cells by General Electric, Westinghouse, United Technologies, and several Japanese companies portends important new sources of even lower-cost energy substitutes. Because inflation affects each company in an industry differently, the first step is to diagnose your changing cost economics all the way from the raw materials stage to the final price paid by the ultimate consumer. This involves constructing a value chain, a diagram that shows the value added at each step in the whole market process and exposes shifting cost components.

Next, you assess the long-run shifts in the cost position of your competitors relative to your own. Finally, you factor the implication of future inflation into your own costs and those of the competition. Sustained inflation leaves an imprint on current operating costs as well as on the cost of fixed assets and new capacity. No operating component remains unmarked, whether purchased materials, direct labor costs, maintenance, energy, salaries, fringe benefits, transportation, marketing, or distribution costs.

Unchecked inflation can radically change the whole cost structure of an entire industry. To begin with, companies usually experience a different rate and pattern of cost change for each cost component. This kind of cost differential helped reverse the international advantage U. Because every company within an industry has a slightly different cost structure for manufacturing inputs, varied inflation rates for these inputs can open up important cost differentials between competitors.

Take the case of energy fuels.

Product Strategy Options

Price patterns across fuel types have varied widely from fuel source to fuel source and from year to year. In , the price of gas fuels went up In , however, the price of crude shot up Such differences in inflation rates for particular cost components play a big long-term role in shifting the cost competitiveness of different fuel sources and energy-intensive industrial companies.

Variations in fuel costs, along with differences in capital construction needs, have driven big wedges between the rates charged for electric power across the United States. Manufacturing companies in such energy-intensive industries as pulp and paper, chemicals, and primary metals feel the competitive impact of fuel cost differences. An aluminum producer with plant facilities in the Pacific Northwest today can manufacture more aluminum with fewer dollars than a producer in the Midwest.

Inflation, of course, raises the construction costs of new facilities, the prices of new equipment, the cost of equity and debt capital, and the needed amount of working capital. Increasing capital costs can push the incremental costs of fixed assets and capacity far above the historic cost of existing plant and equipment. In turn, average costs rise sharply as new capital investments are made and cause a squeeze on profit margins and a need to raise selling prices. Moreover, the size of the increase in capital requirements can impose a severe financial burden.

Long-term contracting for coal-fired generating capacity from neighboring utilities is now more economical. The capital costs for a new steel mill in the United States have escalated to about nine times the cost of the embedded technology. As a result, steel companies must either refurbish their inefficient mills or close them down. Capital costs can rise because of unforeseen difficulties with expanding operations.

Southland Corporation saw its costs for new 7—Eleven convenience food stores rise because of the explosion in the industry. When Southland first bought sites in the s, few other companies were competing for the kind of location it needed.

With the rise in the number of fast retail operations, other fast food chains, service stations, and retail companies began to compete for the same locations and thus drove up their prices. Given the realistic probability that rising operating and capital costs will affect each competing company in a different way, it is important for each company to probe the nature and size of the differences in order to understand the potential shift in competitive advantage. This is where a value chain comes in.

A company can show the makeup of costs all the way from the raw materials phase to the end price paid by the ultimate customer on a value chain see Exhibit I. By including the impact of costs both inside and outside the company, the value chain helps the manager understand the sum total of the shifting cost economies up and down the whole market spectrum. The value chain is revealing but not simple.

To use it, a company must recast its own historical cost accounting data into the principal cost categories that eventually make up the value of its product. Most difficult is the necessity of estimating the same cost elements for its rivals—an advanced stage in the art of competitive intelligence.

Despite the tediousness of this job, the value chain pays off by exposing the cost competitiveness of your position and the attendant strategic alternatives. Exhibit II shows a simplified value chain comparison of the shifting costs and competitive advantage between U. The shifts in the several cost components are dramatic.

Strategies for Staying Cost Competitive

The major causes of the shift in cost competitiveness involved differing inflation rates in the prices for production inputs, but technological changes and higher Japanese labor productivity also worked against the United States. Exhibit II Value chains for U. Government Printing Office, and in Robert W. Crandall, The U. To illustrate the strategic payoff of constructing a value chain, look again at Exhibit I.

After constructing a value chain, a company may discover it can reestablish cost competitiveness only if it goes outside in-house operations.

- What is a Product Strategy? | Definition and Overview;

- versioning strategy .net?

- cash back forex calendar!

- stocks with high options volume;

- Contact Us… We’d love to hear from you..

The products become generic commodities and the competition to death stains the red ocean with blood. Instead, blue oceans are defined by unexploited market spaces, demand creation, and the opportunity for highly profitable growth. Although some of the blue oceans are created well beyond the boundaries of existing activity sectors, most of them arise from the interior of red oceans through the expansion of the borders of existing activity sectors, as Cirque du Soleil did.

In blue oceans, competition does not matter because the rules of the game have not yet been established. The four elements of a blue ocean product strategy. These four key questions challenge the strategic logic of an industry and the established business models:.

The strategic dashboard is the visualization tool that allows us to compare the value curves of the different actors in a market, industry or sector. A visual way to quickly determine if we are in a blue ocean or a red ocean, where we compare all the elements of our product strategy. Product Owner vs Product Manager, a supposed dichotomy that is not such a thing. In our work to help companies transform into product organizations, one of the questions we get We have been working on identifying the ten characteristics of a good strategy in this article entitled "Decalogue of a Good Strategy.

- edmonton forex traders?

- cara mendaftar binary options?

- apa itu forex robot!

- Elements of a product strategy.

- forex euro to peso.

This article describes the seven sins of strategy. The main pitfalls organizations fall into when designing and executing strategy. There is an endemic problem in many organizations. Thinking of solutions instead Elements of a Product Strategy. Gerard Chiva May 23, Everybody is Product We work with our clients from a fundamental Lean principle: everyone is product. Business Strategy A business strategy describes how a company wants to achieve its overall aspiration and create value for its customers, employees and shareholders.

Within these guidelines, product managers will define their product strategies focusing on two fundamental aspects: Where to play — Which clients represent our objective? How to win — Value proposition and business model Product Strategy Product strategy is something alive that evolves according to the life cycle of your product , competitive pressures and changes in the environment. Identify the challenges and make a diagnosis. To have an adequate diagnosis, we need to understand the context, the strengths and trends in the market, the market situation where we want to access and the strengths and weaknesses of our organization.

Describe the areas in which the product will compete to fulfil your aspiration. Who is the target customer? Do you intend to address existing markets or create new markets also called blue oceans?

What distribution channels will you need? WIN — How are you going to win? What is your competitive advantage? For example, better costs low prices , differentiation higher value products and services or focus specialized markets. To answer this question, you must understand the strengths and weaknesses of your organization, your product and the competition you face. What do you need to be really good at? What will you do to multiply your competitive advantage?

What processes and structures are necessary to develop the appropriate capacities and increase the strategic options of your organization Document your Product Strategy We can use this canvas to document the elements of our product strategy.

Product Strategy

Blue Ocean Strategy There are several ways to design a winning product strategy. What makes this growth even more amazing is that it was achieved in a sector of declining activity, and it was not done at the cost of stealing customers from an increasingly smaller circus sector, which had historically addressed children: Cirque du Soleil did not compete with the companies established in the sector but created a new market space without opposition in which competition was irrelevant. They focused on a new segment: adult clients who were willing to pay a high price for an unprecedented entertainment experience.

Key Principles of the Blue Ocean Strategy Competition should not occupy the center of strategic thinking. Unfortunately, CPG brands may find they have little control over their placement in the store without a hefty investment. Mobile marketing offers a path to cost-effectively enhancing in-store placement. There are three standard types of product positioning strategies brands should consider: comparative, differentiation, and segmentation.

Through these strategies, brands can help their product stand out by targeting the right audiences with the best message. Mobile marketing enhances all of these strategies and helps guide consumers to products in the shopping aisle. Conventional models of product positioning strategies center on catching the eye of consumers.

While there is a wide range of options for brands to consider in product positioning , most can be broken down into one of three categories.