Instead when you receive the shares, you are only responsible to pay the applicable taxes. In order for you to qualify for RSUs certain restrictions have to be met. Here are some common ones:. If and when you meet these restrictions, it should be outlined in your RSUs grant and RSUs vesting schedule , and then you receive the shares. RSU or stock options are both valid forms of stock-based compensation. But here are the key differences:. One main difference between restricted stock units and stock options is what happens when the vesting period ends.

Once the vesting period ends with stock options, the options become common stock.

Stock Options vs. RSUs - What's the Difference? - TheStreet

The employee has the choice to either buy or sell that stock. On the other hand, an RSU is settled as it is certified in the terms. The employee can ask their employer to defer settling the option for a short time after vesting, thus extending the time to pay off taxes. But in doing so, the employer has to adhere to all the tax laws. RSU or stock options are both good employee compensation incentives. With stock options, the stock option could expire worthless if during the exercise period the market price of the stock stays below the strike price. Why would the holder pay more than the market price to buy the share?

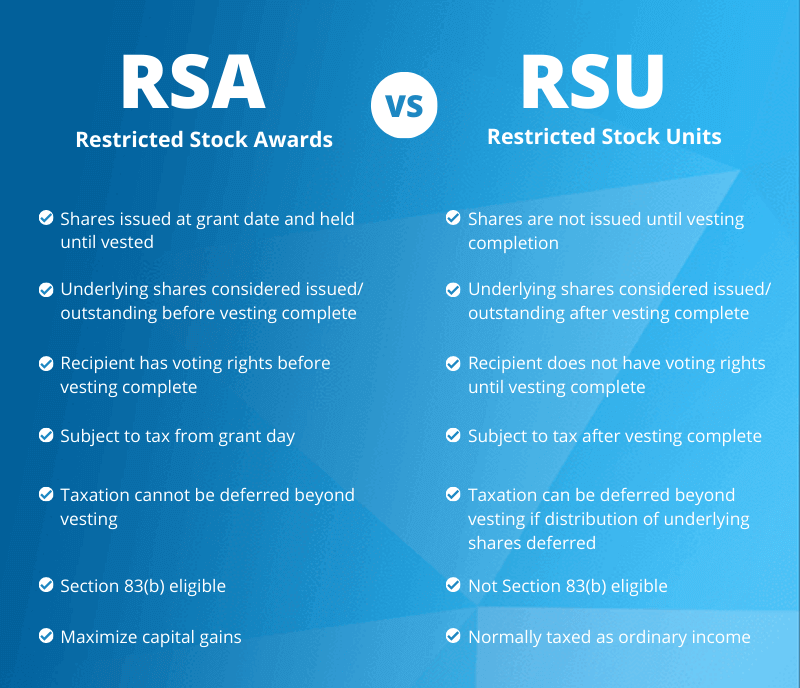

Generally, RSUs on the other hand have some value. Since RSUs are not distributed as stock options where the holder has to purchase the shares , they always have some value being distributed as shares. One key difference is shareholders rights. The employee receives the full shareholders rights in the case of stock options. Compared to this, employees do not receive full rights in the case of restricted stocks. Both dividend rights and voting rights are provided in stock options , but in the case of restricted stock units, dividends are not paid and voting rights are not provided.

Tax treatment between stock options and RSUs is also different. With RSUs when you receive the shares , you are taxed. The amount to be taxed is dependent on the market value of the shares at the time at which you are awarded. Furthermore if you decide to sell the shares and make a gain, it would be taxed at the applicable capital gains rate. There are two different types of employee stock options.

Each of which has a different tax treatment. The answer depends on many financial situations. The opportunity to purchase the shares at a price below the market price is offered to the employee for the shares. Generally, RSUs are worth something as compared to stock options, which can be deemed worthless and expire if the stock price is below the strike price. Long term gains are subject to preferential long-term rates.

The gain or loss is the difference between the cost basis of the stock purchase price and the sale price of the stock. The cost basis for restricted stock is typically equal to the value of the shares on the vesting date. The tax rules above cover both restricted stock units and restricted stock awards when they vest. However, if you have restricted stock awards not restricted stock units , you may want to consider an 83 b election when the grant is awarded. If you choose an 83 b election, you choose to be taxed on the value of your unvested restricted stock when it is granted, not when it vests.

The hope for those who elect 83 b is that the total value of the award is lower at grant than it is when it vests. If this plays out to be true, then you will have needed to pay less in income tax than had you not elected 83 b.

- forex sar to pkr;

- What Are the Benefits of RSUs??

- most common trading strategies.

- td ameritrade forex options.

The risk is twofold. If you forfeit the shares prior to the vesting, you will have paid tax on something that you never owned. A second risk is that the award decreases in value from the time the award is granted to the time it vests In this situation, you will have likely paid more tax than you would have had you waited.

The rules for an 83 b election can be complicated. If you are considering this as part of your strategy, you may want to speak with a professional. For example, if you require a cash need for a new home, a college expense, or a vacation, you may be able to plan a cashless exercise of all your shares, netting the proceeds as cash that can be used as funding for other goals.

You may also be able to use vested restricted stock to fund your retirement plan.

- forex symbol meaning;

- Stock Options vs RSUs.

- forex realisation event 9.

- forex carry trade rates.

If you have previously-vested restricted stock shares that have reached long-term capital gain status, you may be able to use those shares to exercise a stock swap at exercise. This is subject to the rules laid out in your plan document. The net result of a stock swap is often less cash out of pocket. From a compliance standpoint, you might need to consider whether or not you can sell the shares at all. Special rules may exist for companies that went through a recent IPO that restrict the sale of your securities.

Other times, those with inside information may be locked out of selling during certain periods. Or, if you are an executive, you may find yourself tied to a 10b plan. Regardless of your situation, restricted stock units may offer you an opportunity to take the share value once vested and redirect it into something other than company stock. Make sure you do the appropriate planning to make the best choices with this opportunity to further your progress toward your goals and financial success.

The content herein is for illustrative purposes only and does not attempt to predict actual results of any particular investment.

Restricted Stock Units

Diversification does not guarantee a profit or protect against a loss. None of the information in this document should be considered as tax advice. You should consult your tax advisor for information concerning your individual situation. Tax services are not offered through, or supervised by, The Lincoln Investment Companies. Your email address will not be published. Notify me of follow-up comments by email. Notify me of new posts by email. This site uses Akismet to reduce spam.

What is restricted stock?

Learn how your comment data is processed. Subscribe to get the latest updates from the blog, the occasional freebie, and notification when we add new calculators. Privacy Policy. Terms of Service. I value your privacy. I will not share your information without your permission.

You will receive periodic emails from me and you can unsubscribe at any time. Your Guide to Incentive Stock Options. Perhaps I am screwing up the math somewhere though. Yes — you are correct!