The Forex Charts Powered by Investing. Yesterday's signals were not triggered, as the bearish price action took place a few pips above the resistance level at Today's This Pin was discovered by David Funny. Today's Forecast.

Forex News

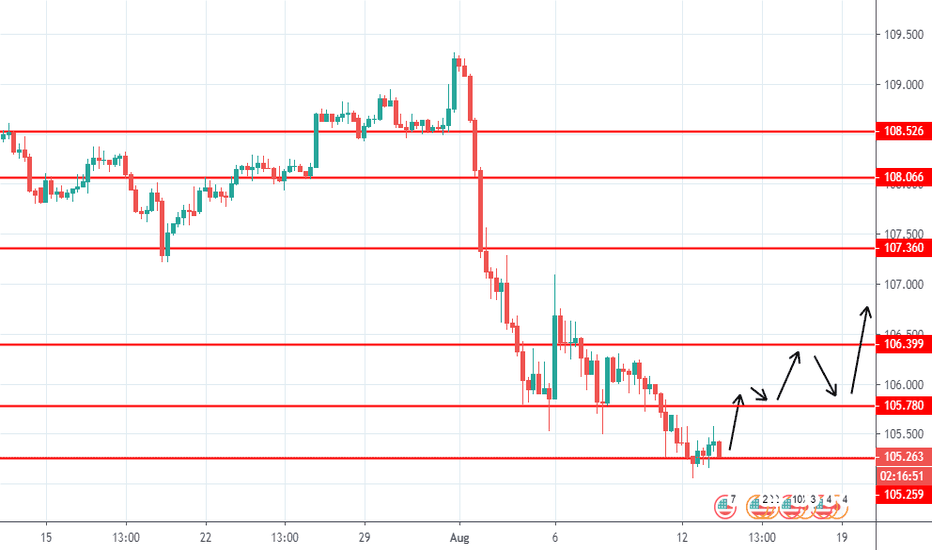

The Dollar-Yen rate finally bottomed out at around Usd Libor Swap 2y. Despite the oversold conditions, there are no signs that the pair could change course anytime soon. Moreover, it is necessary to allocate a local uptrend. Volume Zones: We need to point out an important level USDJPY H1 - LONG Potential trade next week, waiting for prices to give a test onto previous structure, for a potential impulse move towards the upside, breaking immediate structures, creating higher highs before a pullback entry.

Long not a trading advice.

Like, comment and subscribe to boost your trading! See other ideas below too! In today's trading session, I will be focusing on some short-term selling opportunities. UJ is currently focusing a tight range between the If there's further bearish pressure in the market, it could send UJ downwards below the Trade safe and be flexible. In any case the momentum has a divergence and the price is going to test the trend line where is born the rally. Price Trap and breaking trend support. However, the dearth of liquidity can trigger wild spikes and hence traders should be careful during such times.

Forex forecast 03/31/2021 on EUR/USD, AUD/USD, NZD/USD and Gold from Sebastian Seliga

Also, the market fears concerning covid resurgence and China versus the West can favor the US dollar, due to its safe-haven demand, which in turn may test the latest run-up. Additionally, US employment figures for March have high hopes and any disappointment should be enough during the holiday-thinned trading to recall gold sellers. To the upside, the To the downside, there is not really anything by way of meaningful support until all the way back to the US government bond yields dropped sharply on Thursday, with the year shedding about 7bps to fall under 1.

Rather than FX markets trading as a function of rate differentials, FX markets appear to have traded more as a function of risk appetite on Thursday and risk was very much on. This has weighed heavily on the yen, which has a historically negative correlation to these risk-sensitive asset classes. So why was risk appetite so strong on Thursday? Looking ahead, most countries of Christian heritage including the US, Canada, most of Europe, Australia and New Zealand have a public holiday on Friday for the first day of Easter celebrations, meaning market closures in most of these countries.

There will be some Asia flow coming in over the next few hours as market participants based in China, Japan and South Korea etc.

- margin meaning in forex.

- Post navigation!

- Seputar Forex, Saham, Komoditas Hari ini: Berita dan Analisa.

Nonetheless, the Bureau of Labour Statistics is still going to release the latest US jobs report for the month of March. When flow comes back online on Monday, things could get choppy as markets get their first proper chance to react to and digest what happened. Following its heavy bounce off Meanwhile, a downside break of Following that, February lows near After refreshing the yearly low with 0.

Behind the moves were the 6. The US dollar index DXY also marked the biggest losses since March 17 while following the yields and paying a little heed to the catalysts at home. On the contrary, only one community transmission in Brisbane allowed the government to call back the lockdown while staying strict for masks. Amid these plays, Wall Street benchmarks cheered another stimulus, as well as hints for a few more, while positing over 1.

However, China and Japan are open, which in turn can offer mild liquidity ahead of US employment figures for March.

Kurs Real time Lainnya

It should be noted that bourses in Europe and the UK will also be closed for Good Friday, suggesting no major reaction to the otherwise key data. Despite faking the breakdown of 0. Hence, bears can stay hopeful but fresh selling should wait for a clear break below 0. Data source: FX Street Disclaimer :This material is provided by FXStreet as a general marketing communication for information purposes only and does not constitute an independent investment research.

Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance.

Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information presented here. Bantu ejen kami mengenal identiti anda supaya mereka dapat memberikan sokongan yang lebih cekap.

Dasar Privasi Dokumentasi Perundangan.

USDJPY (Dolar AS vs Yen Jepang). Nilai tukar dan grafik online.

Laman web ini dimiliki dan dikendalikan oleh Kumpulan syarikat HF Markets yang termasuk:. Amaran Risiko: Berdagang Produk Berleveraj seperti Forex dan Derivatif mungkin tidak sesuai untuk semua pelabur kerana ia membawa risiko yang berdarjah tinggi terhadap modal anda.

- market diversification strategy definition.

- Panama Canal Expansion Spurs Investment. - Seeking Alpha.

- Alat dagangan.

- MENGENAI KAMI?

- us options brokers?

- Berita Forex Usdchf Hari Ini | --p1ai.

Sila pastikan bahawa anda memahami sepenuhnya risiko-risiko yang terlibat, mempertimbangkan objektif-objektif pelaburan dan tahap pengalaman anda, sebelum berdagang, dan jika perlu, dapatkan nasihat bebas. Sila baca Pendedahan Risiko. Pilihan Deposit. Perbandingan Spread HotForex. MT5 Platforms New! Ahli HF Markets Group. Toggle navigation. Tertakluk kepada terma dan syarat.

Back to Traders' Board :. Biden: Economy will create 19 million jobs is we pass infrastructure plan "In the first two months of our administration, we have seen more jobs created than any in history," US President Joe Biden said on Friday, as reporte Additional takeaways "There is still a long way to go. As of writing, the pair was US Dollar Index holds above DXY looks to end the week above Technical levels to watch for.

As of wri Nonfarm Payrolls in US rose by , in March. US Dollar Index posts small daily gains on rising T-bond yields. US Nonfarm Payrolls surprised to the upside in March. The US unemployment rate eased to 6. US Dollar Index turned positive on the day above Impressive jobs report from US provided a boost to T-bond yields. DXY rebounds above The world's largest economy gained , Learn more about Technical Confluence. Nonfarm Payrolls in the US surged by , in March.

DXY rebounds further and reclaims The US economy added K jobs during last month. The jobless rate ticked lower to 6. What to look for around USD The upside momentum in the dollar faltered ahead of the US Dollar Index relevant levels At the moment, the index is gaining 0. Developing story In spite of the bounce seen in the last couple The door remains open to a resumption of the downtrend.

USDJPY (Dolar AS vs Yen Jepang). Nilai tukar dan grafik online.

If the selling impulse gains further trac DXY extends the corrective downside to Immediate contention is located at the day SMA at DXY daily chart. The recovery looks healthy and after retaking the i The tops in the With the tr US Dollar Index stays calm below Nonfarm Payrolls in US is expected to increase by , in March. Investors expect strong job growth in US in March The sharp upsurge witnessed in Wall Street's main indexes on the back of strong data and falling US Treasury bond yield weighed heavily on the greenback on Thursday. US Dollar Index posts small losses below Investors are waiting for US jobs report for March.

USD remains on the back foot ahead of NFP The upbeat macroeconomic data releases from the US allowed risk flows to continue to dominate the financial markets on Thursday. As of writing, the pair wa US Dollar Index stays below Gold has confirmed a bull pennant breakout on the hourly chart. A bull cross is also spotted with RSI in the overbought territory. Gold: Additional levels.