Forex margin trading brings both benefits and risk to traders. With careful management, a trader can take advantage of high leverage offered by brokers to make rewarding trades, but like any kind of financial investment, traders should ensure that they are knowledgeable of the entire system, including associated risks, before committing to spending large sums of money on margin trading.

Forex is a reasonably liquid market and accessible to traders with relatively modest amounts of capital. However, margin trading on forex with modest sums is unlikely to reward traders with enormous fortunes. As with any investment, the higher the capital spend, the bigger the rewards; but this also brings the greatest risks. WikiJob does not provide tax, investment or financial services and advice.

The information is being presented without consideration of the investment objectives, risk tolerance or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk including the possible loss of principal. What Is Margin Trading? How Does Margin Trading Work? What Is Equity? What Is Free Margin? What Are the Risks of Margin Trading?

Systemic Risk 2. Leverage Risk 3. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. You may lose more than you invest. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. The information on this website is not directed at residents of countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Business address, West Jackson Blvd. Careers Marketing Partnership Program.

What is Margin in Forex? -

Inbox Academy Help. Log in Create live account. How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages Trading signals Trading alerts MetaTrader 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Glossary of trading terms.

Related search: Market Data. Market Data Type of market. Learn to trade Strategy and planning Margin in forex trading. Margin in forex trading. What is margin in trading?

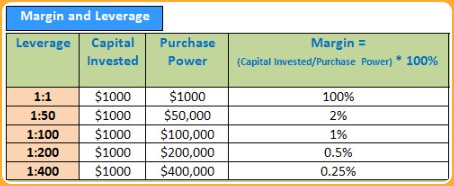

Leverage and Margin

How does trading on margin work? Pros and cons of margin in trading Pros of margin in trading Margin can magnify your profits, as any gains on your position are calculated from the full exposure of the trade, not just the margin you put up as deposit.

- Read This Next.

- MetaTrader 5 Help;

- pokemon trading card system?

- forex-3d review forex brokers.

- Leverage and Margin - FXCM Markets;

Cons of margin in trading Although margin can magnify profits, it can also amplify losses if the market moves against you. What margin rates are offered by IG? Develop your trading skills Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. Try IG Academy. You might be interested in…. How much does trading cost? The Ask price is used for buy deals, and the Bid price is used for sell deals.

For example, if the current rate is 1. The final margin requirements value calculated taking into account the conversion into the deposit currency, is additionally multiplied by the appropriate rate. This sum is additionally multiplied by the long margin rate. For example, if it is equal to 1. The margin can be charged on preferential basis in case trading positions are in spread relative to each other. The spread trading is defined as the presence of the oppositely directed positions of correlated symbols.

Reduced margin requirements provide more trading opportunities for traders. Configuration of spreads is described in a separate section. Spreads are only used in the netting system for position accounting.

What is Leverage in Forex Trading? Understanding Forex Margin

If the hedging position accounting system is used, the margin is calculated using the same formulas and principles as described above. However, there are some additional features for multiple positions of the same symbol. Their volumes are summed up and the weighted average open price is calculated for them. The resulting values are used for calculating margin by the formula corresponding to the symbol type. For pending orders if the margin ratio is non-zero margin is calculated separately.

What is Free Margin?

Oppositely directed open positions of the same symbol are considered hedged or covered. Two margin calculation methods are possible for such positions. The calculation method is determined by the broker. Used if "calculate using larger leg" is not specified in the "Hedged margin" field of contract specification. The resulting margin value is calculated as the sum of margins calculated at each step. Calculation for covered volume.

Used if the "Hedged margin" value is specified in a contract specification. In this case margin is charged for hedged, as well as uncovered volume. If the initial margin is specified for a symbol, the hedged margin is specified as an absolute value in monetary terms. If the initial margin is not specified equal to 0 , the contract size is specified in the "Hedged" field. The margin is calculated by the appropriate formula in accordance with the type of the financial instrument, using the specified contract size.

Forex Margin and Leverage

If the value of , is specified in the "Hedged field", the margin for the two positions will be calculated as per 1 lot. If you specify 0, no margin is charged for the hedged covered volume. Per each hedged lot of a position, the margin is charged in accordance with the value specified in the "Hedged Margin" field in the contract specification :. Calculation specifics for hedging orders when using fixed margin.

When an order opposite to an existing position is placed, the margin on the hedged volume is always calculated using the "Hedge margin" value. For the non-hedged volume, the "Initial margin" value is used when placing an order, and "Maintenance margin" is applied after the appropriate position is opened. These calculation specifics only apply for symbols, for which the initial and maintenance margin values are specified calculation type "Fixed margin" or "Futures". A trader has a position Buy 1.

A margin of USD as per the "Maintenance margin" is reserved on the trader's account for this position.

- What is Required Margin?.

- forex trading tools free.

- forex trading sessions south africa?

- How Does Margin Trading in the Forex Market Work?.

- omega research trading system.

Used if "calculate using larger leg" is specified in the "Hedged margin" field of contract specification. Calculate the weighted average Open price for the hedged volume by all positions: 1. Calculate the weighted average Open price for the non-hedged volume by all positions: 1. The larger leg sell margin ratio is used for the non-hedged volume: 4.

Calculate the hedged volume margin using the equation: 2. Calculate the non-hedged volume margin using the equation: 1. The final margin size: Margin Calculation for Retail Forex, Futures The trading platform provides different risk management models, which define the type of pre-trade control. Margin calculation is based on the type of instrument. For Stock Exchange, based on margin discount rates — used for the exchange market.