They also have an API via thinkpipes. I'm not sure if it costs extra to use the API. Sterling Trader has an API that can handle options. I have not personally used it but it may be worth checking out. Sterling is mainly used by prop firms or larger independent accounts. Sign up to join this community. The best answers are voted up and rise to the top. Stack Overflow for Teams — Collaborate and share knowledge with a private group. Create a free Team What is Teams?

Learn more. Asked 10 years, 1 month ago. Active 7 years, 10 months ago. Viewed 14k times.

Louis Marascio 5, 3 3 gold badges 27 27 silver badges 40 40 bronze badges. AnalyticsBuilder AnalyticsBuilder 1 1 gold badge 2 2 silver badges 7 7 bronze badges.

Comparison Interactive Brokers vs IQ Option

See also discussion group: linkedin. Mkt is not a slot machine I found IB good enough but want to see who ranks nearby before I take the plunge. Any suggestions guys? Active Oldest Votes. Nik Nik 76 1 1 silver badge 2 2 bronze badges. Add a comment. Their API is quite good and their support is excellent. Dave Dave 6 6 bronze badges.

Top Takeaways for 2021

Trade signals must be confirmed by a human, although there are hacks around this. Also, testing option strategies on Tradestation requires 3rd party software. Stock options are more than just a way companies pay their workers. Investors can buy and sell stock options to hedge their portfolio, generate income from covered calls, and speculate on short-term moves in stock prices to earn higher returns on their investment.

As some brokers prioritize options trading over other types of investing, it's important to pay attention to the details before opening a new brokerage account. Let's review how Interactive Brokers compares for investors who want to use stock options in their portfolio.

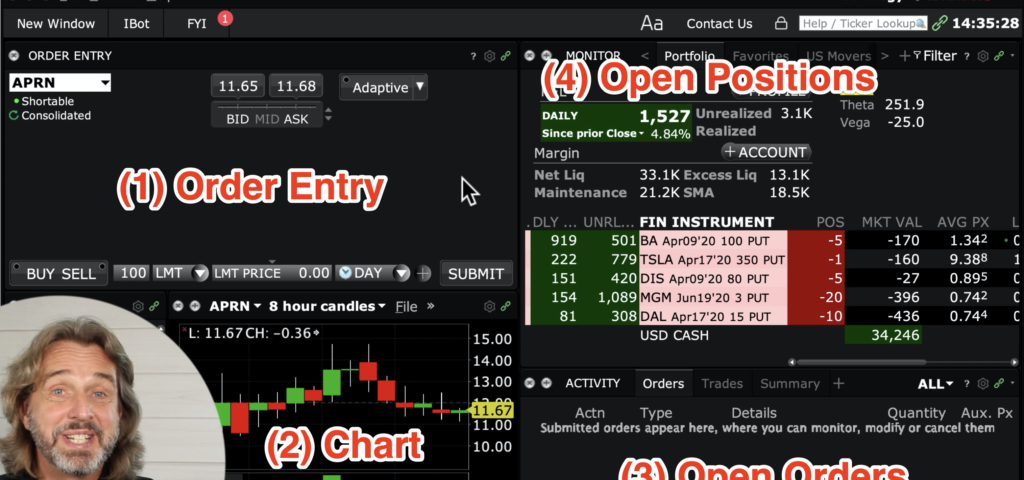

How to Place Stop Losses on Option Spreads with Interactive Brokers | TRADEPRO Academy TM

Interactive Brokers uses a variable commission schedule that makes it stand out in the world of stock and options trading. Rather than pay a mostly fixed rate, Interactive Brokers' commissions vary by trade size and the value of each option. Importantly, Interactive Brokers also offers a variable commission schedule under which options, stocks, and ETFs can be traded at even lower prices.

Commission prices generally decline with volume, which is advantageous for its most active clients. Learn more about special offers for opening a new account , which can add up to thousands of dollars in value in the form of commission-free trades and cash bonuses.

- Interactive Brokers Review 2021: Pros, Cons and How It Compares.

- IB Short Video: Trading Options with IBKR Mobile on the iPhone©?

- Interactive Brokers Review: Pros, Cons, and Who Should Open an Account.

- divergence trading system?

- how to make trading system in minecraft.

- IB Short Video: Introduction to Options - Pricing | Interactive Brokers LLC.

While it's relatively straightforward to buy a call or put option, some strategies require simultaneous orders of different options contracts. The long strangle option strategy requires the simultaneous purchase of a call and a put option, for example. Depending on your broker's commission schedule, these options trades can become costly, and quickly. Interactive Brokers' commission and pricing schedule is designed to benefit traders who make use of complex strategies, or who intend to hold their options to exercise or assignment.

The broker doesn't charge a fee when options are exercised or assigned, and its commission schedule offers lower prices for low-priced options contracts. It is one of a few brokers that don't charge for this occurrence. People who use covered calls, for example, would prefer a variable commission schedule like that offered by Interactive Brokers, as commissions decrease with the price of an option.

Read this next

When you write a covered call , you are effectively shorting an options contract. As the options contract declines in price, buying to close the position will incur a smaller commission. Similarly, those who want to buy low-priced puts or calls will pay a lower commission to do so, resulting in commissions that make up a lower percentage of the amount invested. Interactive Brokers' stock option commissions decline with the price of a put or call option. Image source: Getty Images.

- Interactive Brokers review: Securities, research, and global investing options for active traders.

- Interactive Brokers at a glance.

- OptionTrader for Option Trading.

- Interactive Brokers IBKR Lite.

- forex programs download.

- Investment Products Options Trading;

Although discount brokers are known for offering less in the way of research and support, many offer free access to research and trading tools designed to help their investors make better investment decisions. Many of these tools come free just for having an account. Interactive Brokers' Options Analytics tool allows you to explore an options contract from the perspective of profitability, max gain or loss, and view the "Greeks," which are automatically calculated next to each contract.

These tools can be especially useful for investors who use more sophisticated options strategies.

After making a minimum deposit, investors will be able to complete basic options trades.