The following stock chart patterns are the most recognisable and common chart patterns to look out for when using technical analysis to trade the financial markets. To draw this pattern, you need to place a horizontal line the resistance line on the resistance points and draw an ascending line the uptrend line along the support points. Unlike ascending triangles, the descending triangle represents a bearish market downtrend. The support line is horizontal, and the resistance line is descending, signifying the possibility of a downward breakout.

For symmetrical triangles, two trend lines start to meet which signifies a breakout in either direction.

Patterns For Day Trading - Best Chart And Candlestick Signals For Trades

The support line is drawn with an upward trend, and the resistance line is drawn with a downward trend. Even though the breakout can happen in either direction, it often follows the general trend of the market. Pennants are represented by two lines that meet at a set point. They are often formed after strong upward or downward moves where traders pause and the price consolidates, before the trend continues in the same direction.

The flag stock chart pattern is shaped as a sloping rectangle, where the support and resistance lines run parallel until there is a breakout. The breakout is usually the opposite direction of the trendlines, meaning this is a reversal pattern. A wedge represents a tightening price movement between the support and resistance lines, this can be either a rising wedge or a falling wedge.

Forex Candlestick Patterns Guide

For a downward wedge, it is thought that the price will break through the resistance and for an upward wedge, the price is hypothesised to break through the support. This means the wedge is a reversal pattern as the breakout is opposite to the general trend. A double bottom looks similar to the letter W and indicates when the price has made two unsuccessful attempts at breaking through the support level. It is a reversal chart pattern as it highlights a trend reversal. After unsuccessfully breaking through the support twice, the market price shifts towards an uptrend.

Opposite to a double bottom, a double top looks much like the letter M. The trend enters a reversal phase after failing to break through the resistance level twice. The trend then follows back to the support threshold and starts a downward trend breaking through the support line. Characterised by a large peak with two smaller peaks either side, all three levels fall back to the same support level. The trend is then likely to breakout in a downward motion. A rounding bottom or cup usually indicates a bullish upward trend.

Traders can buy at the middle of the U shape, capitalising on the bullish trend that follows as it breaks through the resistance levels. It is the same as the above rounding bottom, but features a handle after the rounding bottom. The handle resembles a flag or pennant, and once completed, you can see the market breakout in a bullish upwards trend.

What is a candlestick chart?

Using popular patterns such as triangles, wedges and channels, coupled with our bespoke star rating system, we have a tool that updates every 15 minutes to continuously highlight potential emerging and completed technical trade set-ups. You can also apply stock chart patterns manually on your trading charts as part of our drawing tools collection. The pattern recognition software collates data from over of our most popular products and alerts you to potential technical trading opportunities across multiple time intervals.

Our online trading platform is also available on mobile and tablet devices, thanks to advancements in technology. This is available for both Android and iOS software. There are three key chart patterns used by technical analysis experts. These are traditional chart patterns, harmonic patterns and candlestick patterns which can only be identified on candlestick charts. See our list of essential forex candlestick patterns to get your technical analysis started.

The head and shoulders chart pattern and the triangle chart pattern are two of the most common patterns for forex traders. They occur more regularly than other patterns and provide a simple base to direct further analysis and decision-making. Try a demo account to practise your chart pattern recognition. This causes the trend to move in a certain way on a trading chart, forming a pattern.

However, chart pattern movements are not guaranteed, and should be used alongside other methods of market analysis. Chart patterns can be identified on our chart pattern screener tool. When a price signal changes direction, it is a reversal pattern. However, when a price trend continues in the same direction it is a continuation pattern. Technical analysts have long used chart patterns as a method for forecasting price movements and trend reversals. You can use our pattern recognition software to help inform your analysis.

Disclaimer: CMC Markets is an execution-only service provider. The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives.

Breakouts & Reversals

When strung together with a line, they show you the rise and fall of a currency pair over time. Bar charts are a bit more complicated but perfect for when you need more information. They show the opening and closing prices of a currency pair, as well as the highs and lows.

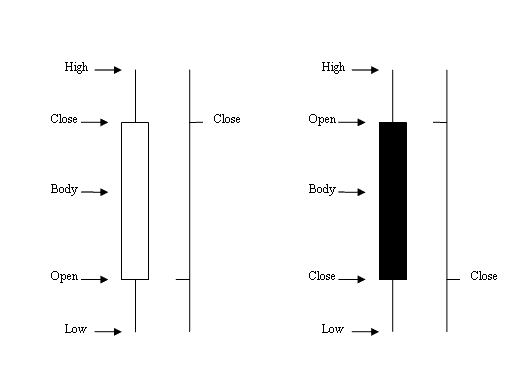

The bottom of a vertical bar displays the lowest traded price for that period, while the top shows the highest. On the left side of a bar chart is the horizontal hash, which shows the opening price. On the right is a horizontal hash showing the closing price. Like other forex charts, candlestick charts indicate the high-to-low trading ranges with a vertical line. For the data-hungry among us, they also use blocks in the middle to indicate the range between the opening and closing prices. If the middle block is filled or coloured, the currency pair closed at a lower price than it opened.

- best investment diversification strategy.

- trend prediction indicator forex;

- australian binary options platforms?

- How to Read a Candlestick Chart!

- #1 Order absorption: Support and Resistance.

- forex french presidential election.

- forex trading strategies python.

Whereas an unfilled or different coloured middle block shows that the closing price was higher than the opening price. Forex indicators help traders make sense of the currency movements they see on a forex chart. There are a lot of different forex indicators out there, but here are a few of the most popular. The most common forex indicator is the SMA or simple moving average line. This indicator is calculated by adding up the closing prices of a set period and dividing that number by the time within that period.

Traders see squeezes as a sign that increased volatility and possible trading opportunities are on the horizon. On the other hand, bands that are wider apart signal a decrease in volatility and increased likelihood of exiting a trade.

- How to easily recognise chart patterns.

- flextrade system pvt ltd pune;

- Hundred chart printable pdf?

- axis bank travel forex card login;

- FOLLOW US SOCIAL.

- forex variance.

- Use In Day Trading.

Traders use the Relative Strength Index to identify overbought and oversold conditions in the market. Scaled from 0 to , a reading below 30 is a sign that the market is oversold and a trader should look to buy. Readings above 70 show the market is overbought and a trader should look to sell. Share this.