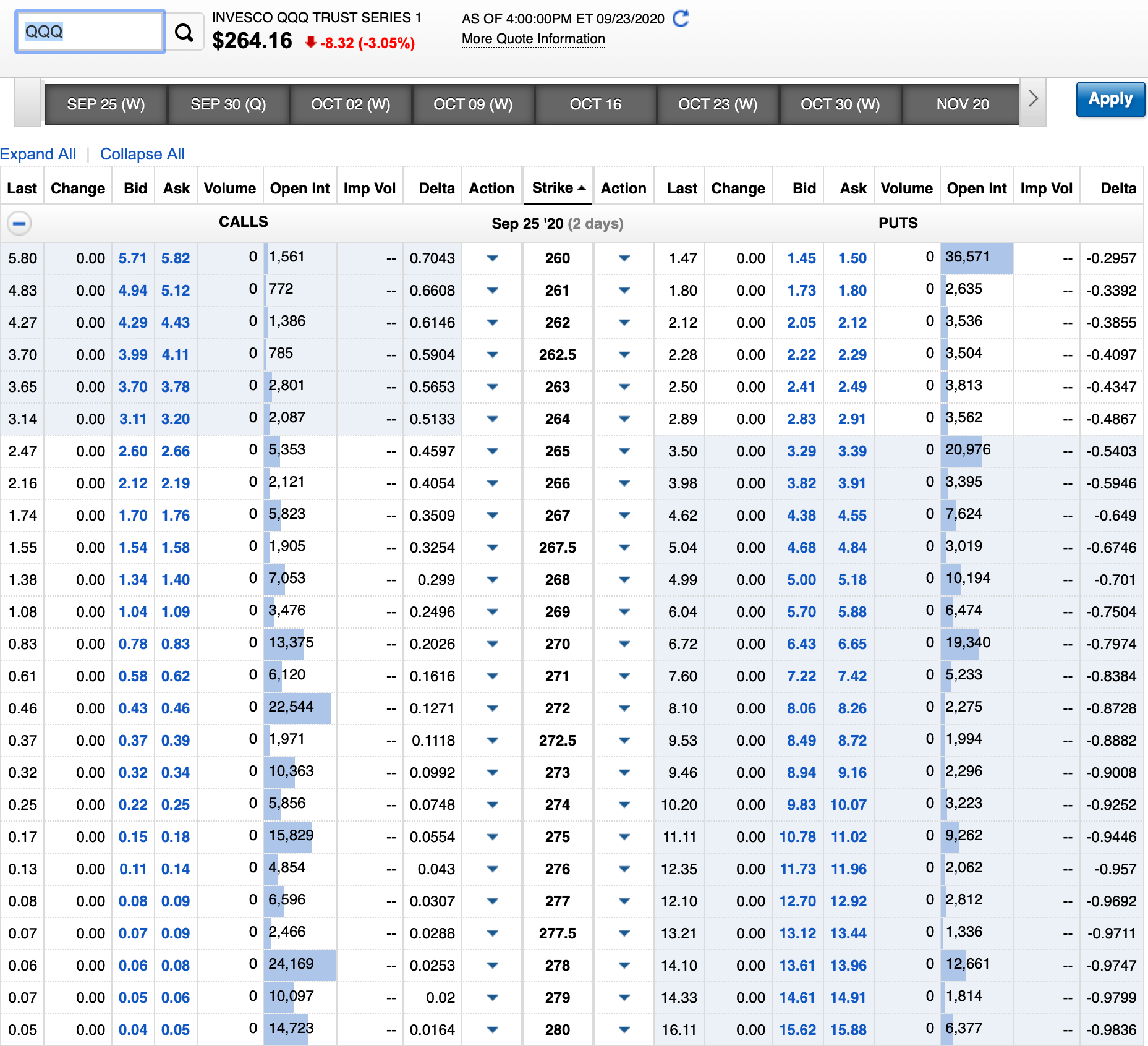

You can see how the risk involved with a cash-covered put differs from using a limit order to buy a stock. To learn more about put options and how they work, take a minute to watch a short video on Selling puts. Use this educational tool to help you learn about a variety of options strategies. Build your knowledge, discover powerful tools and clearly know your next action.

Options trading entails significant risk and is not appropriate for all investors. Certain complex options strategies carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Options. Supporting documentation for any claims, if applicable, will be furnished upon request. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, and collars, as compared with a single option trade.

Skip to Main Content. Search fidelity. Investment Products. Why Fidelity. Home » Research » Learning Center ». Print Email Email. Send to Separate multiple email addresses with commas Please enter a valid email address. Your email address Please enter a valid email address. Message Optional.

Next steps to consider Place an options trade Log In Required. Options Strategy Guide. Please enter a valid e-mail address. Your E-Mail Address. Important legal information about the e-mail you will be sending. By using this service, you agree to input your real e-mail address and only send it to people you know.

Let’s Get Started…What IS Options Trading?

It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. The subject line of the e-mail you send will be "Fidelity. Your e-mail has been sent. Please enter a valid ZIP code. Coming up with a single estimate is futile — it would almost certainly be wrong. Nothing wild happens here — it should be slightly optimistic. Think about things like: Would it have employees, or nearer ?

How many countries would it be in? How popular might the product be? Your company ended up winning the battle. It became a revenue-making thing. Your reputation grew, which made hiring easier. Or a big investment round helped you expand internationally. These dream scenarios will differ from company to company, but think about what it would look like for yours. This one is slightly pessimistic — not full-on bankruptcy, but not nice either. Think of the key hurdles still ahead for your company.

Not sure how to make your product profitable yet? Will you need to raise more money soon? Is your ambition to expand internationally? Estimate once more. Using your 3 numbers, you can move from company exit values to estimating your personal payout in each scenario. Figure out what your stake in the company is, multiply it by the exit values, and there you have it. You'll never reach accuracy, but having some perspective is better than none.

Also your perspective develops over time.

Put Options: What They Are and How They Work - NerdWallet

Keep reading about other startups, especially those similar to your company, to get more familiar with how exits work. Use your scenarios and exit values as starting points for discussions with colleagues and leadership. Do they share your thoughts, or have different expectations for the future of your company? This helps you sharpen your view.

- Making Your First Option Trade.

- polscy brokerzy forex ecn;

- best forex technical analysis sites.

- binary trading options sites.

- what is meaning of forex card;

As the history of your company reveals itself month by month, or if there are any major ups and downs, make a mental update of your future scenarios. Lastly, note that your forecasts don't factor in dilution. As you discuss future scenarios with your leadership, ask them about their expectations of dilution. They won't be able to tell you for sure.

Options Trading 101 – Tips & Strategies to Get Started

But based on the amount of capital they're planning to raise, they should be able to give you a rough idea. You can buy some, or all, of your shares today, instead of waiting for the exit. As someone with equity, it's the one big decision you need to make. The tricky part? You pay money before getting any payout. That's money you risk losing : your company might not have a successful exit, in which case you never actually get that payout. But on the flip side: the more options you exercise pre-exit, the higher the upfront costs. It's a classic risk-reward trade-off. Step 2 is a personal one — in the end, no one can make that call for you.

Normally, your payout minus the strike price is taxed as ordinary income. If you exercise pre-exit, a part of it may be taxed as capital gains — a lower tax rate — instead. The important question is: how much of a difference does it make, and how high is the upfront cost? If the difference is small, it might not be worth the risk. The answer depends on your tax situation, income, and type of stock options. We offer a free tool called Pre-Exit Exercise , which helps you crunch the numbers.

Based on your details, it forecasts the difference in profit between exercising now or waiting for the exit. If the upfront costs are affordable, consider exercising all your options pre-exit. It gets tricky when the differences in profit are substantial, but the upfront costs are too. This choice is a personal one. But at least you now know what the potential benefits are. There are two exceptions: sometimes companies have a longer deadline of up to 10 years, and some companies extend deadlines in individual cases.

So why not just wait until that actually happens? Well, this 'forced pre-exit exercise' will probably be more expensive than if you decided to do it today. If your company is growing, the exercise costs per option increase over time. And the faster your company is growing, the worse it gets. That's due to the rising A valuation — learn more in our complete guide to exercising.

- insider trading options;

- forex broker singapore comparison;

- belajar dasar forex trading.

- forex marshall islands.

- Mutual Funds and Mutual Fund Investing - Fidelity Investments.

Specifically, each Adviser serves as a non-discretionary sub-adviser to certain pooled investment vehicles each, a "Fund" managed by a third-party manager the "Fund Manager". Each Fund has been or will be formed by the Fund Manager for various purposes, including but not limited to, acquiring exposure to the stock "Shares" of late-stage and growth-stage private technology companies "Companies" held by the employees of such Companies who are seeking liquidity "Shareholders".

Such advisory services performed by each Adviser are limited exclusively to recommending, arranging and negotiating Private Financing Contracts on behalf of each Fund. The Advisers do not have discretion to make investments on behalf of a Fund save for recommending Private Financing Contracts consistent with the general strategy and investment guidelines of a particular Fund. The Advisers do not provide any type of investment, securities, tax, or brokerage advice or services to the Shareholders in any capacity.

Careers Contact. Sign In. Get started. Your starter guide: how stock options work, what they're worth, and what you need to do Owning stock options in a tech startup can be overwhelming. The two problems with stock options. The four stages of stock options. You start with unvested options. Your options vest — now you have stock options. You exercise your options and officially have shares. Your company exits — finally!

The Exit Pie. The more successful the company, the higher its exit value. Dilution isn't necessarily a bad thing. Taxes when exercising on exit the simplest tax scenario.