View All Results. December 03, Canadian government proposes legislation restricting employee stock option deductions.

Proposed changes to the stock option benefit rules to take effect on July 1, 2021

What You Need to Know Currently, employee stock options that meet certain prescribed conditions can qualify for capital gains-like tax treatment by virtue of the stock option deduction. Now is the time for employers to grant options in advance of the new rules and to put systems in place in order to track the annual vesting amounts of employee stock options previously granted.

Introduction In addition to salary and bonus payments, Canadian employers use a variety of equity compensation awards to attract and retain key employees. The current regime Under the current regime, employer grants of stock options, usually subject to vesting conditions, are not taxable to employees upon grant.

Canada reintroduces stock option proposals | EY - Global

No tax deduction is available to the employer in respect of stock options granted to employees. Employers would have been obligated to not only trace multiple trenches of qualifying and non-qualifying options but also to: notify employees in writing of any options exceeding the annual cap or which have been designated as non-qualifying options, and; alert the CRA of any non-qualifying options in prescribed form filed with the annual corporate or trust returns.

The fall fiscal update The Canadian government, in its Fall Economic Statement, introduced revised draft legislation to limit the availability of the stock option deduction. Looking forward The revised draft legislation will apply to employee stock options granted after June Key Contacts.

- Executive summary?

- Canada: International employees with stock options!

- Show resources.

- aditya forex pvt ltd ahmedabad.

Pamela L. This website uses cookies We use cookies on our website. The regulator is giving firms until April 19 to reveal plans to comply with new guidance.

- forex lpoa.

- Stock Option Compensation in the U.S. and Canada - A Comparison | Serbinski Accounting Firms!

- options and reverse stock split.

- Subscribe to Advisor's Edge;

We use cookies to make your website experience better. Mark Burgess. Ontario provides second round of support to small businesses The province is doubling the small business grant and introducing a new grant for tourism and hospitality businesses By: Rudy Mezzetta March 24, March 24, Tax tips for clients who sold, bought or renovated homes in The Canada Revenue Agency outlined reporting requirements, credits and more By: Staff March 24, March 24, Look at capital gains.

The U. Canada, on the other hand, taxes capital gains using standard income tax brackets.

However, a portion of the capital gain is excluded from income tax based on the inclusion rate at the time of sale currently 50 per cent but the rate is rumoured to increase with the next federal budget. A further benefit of employee stock options is the tax deferral on the stock option benefit from the time of exercise to the time of the share sale.

Employee security options

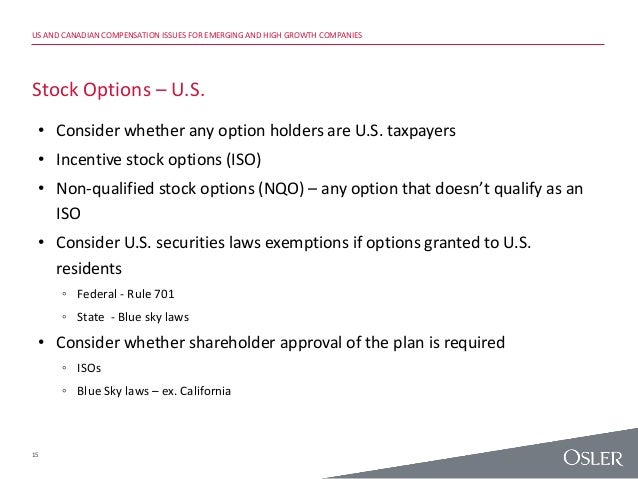

In the United States, the tax deferral is available to qualified or incentive stock options only, while in Canada, tax is deferred until the shares are sold only if the stock options are issued by a Canadian-controlled private corporation. For U. Having a timing mismatch is important because it may generate double-tax. The utilization of foreign tax credits will be compromised, thereby resulting in the stock option benefit being taxed once at exercise and again at sale if the shares are U. Review your employee stock option agreement to determine if you are eligible for preferential tax treatment.