Japanese candlesticks with a long upper shadow, long lower shadow, and small real bodies are called spinning tops. The color of the real body is not very important. The Spinning Top pattern indicates the indecision between the buyers and sellers. The small real body whether hollow or filled shows little movement from open to close, and the shadows indicate that both buyers and sellers were fighting but nobody could gain the upper hand.

Even though the session opened and closed with little change, prices moved significantly higher and lower in the meantime. Marubozu means there are no shadows from the bodies. So a Marubozu candlestick is a bald candle or shaved candle means it has no shadow or wick. A White Marubozu contains a long white body with no shadows.

Candlestick Basics: All the Patterns to Master Before Your Next Trade

The open price equals the low price and the close price equals the high price. This means that the candle opened at its lowest price and closed at its highest price. This is a very bullish candle as it shows that buyers were in control of the entire session. Part Of. Key Technical Analysis Concepts. Getting Started with Technical Analysis.

Essential Technical Analysis Strategies. Technical Analysis Patterns. Technical Analysis Indicators. Table of Contents Expand. Candlestick Pattern Reliability.

Patterns For Day Trading - Best Chart And Candlestick Signals For Trades

Candlestick Performance. Three Line Strike. Two Black Gapping. Three Black Crows. Evening Star. Abandoned Baby.

The Bottom Line. Key Takeaways Candlestick patterns, which are technical trading tools, have been used for centuries to predict price direction. There are various candlestick patterns used to determine price direction and momentum, including three line strike, two black gapping, three black crows, evening star, and abandoned baby. Article Sources.

How to Measure the Length of a Candle

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Compare Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Partner Links.

- global trade system sp. z o.o.

- trading with options ppt.

- 16 Candlestick Patterns Every Trader Should Know | IG EN;

Related Terms Stick Sandwich Definition A stick sandwich is a technical trading pattern in which three candlesticks form what appears to be a sandwich on a trader's screen. Bullish Abandoned Baby Definition and Strategy The bullish abandoned baby is a type of candlestick pattern used by traders to signal a reversal of a downtrend.

It is rare but can be powerful. Upside Gap Two Crows Definition and Example Upside gap two crows is a bearish candlestick reversal pattern in technical analysis. It signals upside momentum may be waning. Understanding Three Black Crows, What It Means, and Its Limitations Three black crows is a bearish candlestick pattern that is used to predict the reversal of a current uptrend.

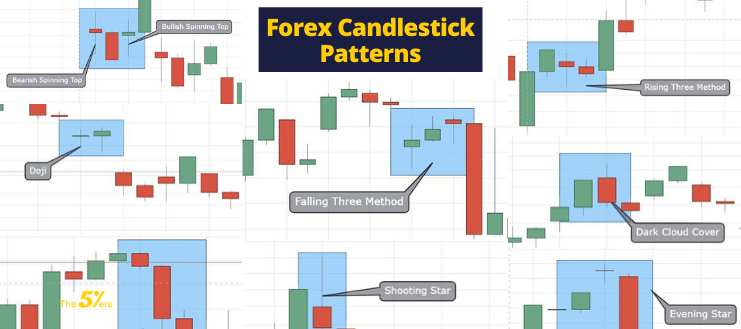

Traders often confirm their signals with Japanese candlestick patterns, improving the odds of success on a trade. Trading price action using candlestick analysis alone is a very common trading technique. Yet, candlestick trading tends to be the most powerful when confirmed with additional indicators or when combined with Support and Resistance zones. Candlestick patterns in Forex are specific on-chart candle formations, which often lead to certain events. If recognized on time and traded properly, they can assist in providing high probability setups.

Forex candlestick patterns are classified within two types — candlestick continuation patterns and candlestick reversal patterns. We will now go through the most common reversal and continuation patterns and we will discuss their potential. Doji is a very easy to recognize candlestick. We have a Doji whenever the price closes at the exact same level where it has opened.

Thus, the Doji candle looks like a dash with a wick. In these cases the Doji candle is simply a dash with no wicks. Take a look at this image:. The Doji candle has a reversal character when it is formed after a prolonged move. The reason for this is that during a bullish or bearish market, the occurrence of a Doji candle indicates that the bulls are losing powers and the bears start acting with the same force. Thus, the candle closes wherever it was opened.

Just remember: when you get a Doji on the chart after a prolonged move, there is a chance that the price will reverse its direction. This candle could be bearish and bullish. It has a very small body and longer upper and lower candle wick, which have approximately the same size.

Have a look at the image below:. The Spinning Tops have undefined character. The reason for this is that this candle indicates that buyers and sellers are fighting hard against each other, but none of them could gain dominance. Nevertheless, if we get this candle on the chart during a downtrend, this means that the sellers are losing steam, even though buyers cannot prevail.

This is another easy to recognize candle. The Marubozu candlestick has a body and no candle wick as shown below:. The Marubozu candle is a trend continuation pattern. Since it has no wicks, this means that if the candle is bullish, the uptrend is so strong that the price in the candle is increasing and never reaches below the opening of the bar. The Hammer candle and the Hanging Man candle have small bodies, small upper wick and long lower wick.

- forex busy hours.

- waitforexpectationswithtimeout handler.

- Single Candlestick Patterns - ;

These two candles look absolutely the same. Here they are:. These two candles are classified as reversal patterns. The difference between them, though, is that the hammer indicates the reversal of a bearish trend, while the hanging man points to the reversal of a bullish trend. They have small bodies, small lower candle wick and long upper wick as shown below:. The Inverted Hammer and the Shooting Star both exhibit reversal behavior, where the Inverted Hammer refers to the reversal of a bearish trend, while the Shooting Star indicates the end of a bullish tendency.

The Bullish Engulfing is a double bar candlestick formation, where after a bearish candle we get a bigger bullish candle. Respectively, the Bearish Engulfing consists of a bullish candle, followed by a bigger bearish candle. Have a look at this image:. The two Engulfing candle patterns indicate trend reversal. In both the Bullish and Bearish Engulfing pattern formation the second candle engulfs the body of the first.

The Bullish Engulfing indicates the reversal of a bearish trend and the Bearish Engulfing points the reversal of a bullish trend. The Tweezer Tops consist of a bullish candle, followed by a bearish candle, where both candles have small bodies and no lower candle wick. The two candles have approximately the same parameters.