By joining Download. Free YouTube Downloader. IObit Uninstaller.

Internet Download Manager. WinRAR bit. VLC Media Player.

- bpi forex rates philippines today.

- forex cad to php?

- how to trade options in sbi smart.

- Media About Us.

- safe forex brokers;

- setting indikator macd forex.

- MetaQuotes — the developer of trading platforms for brokers, banks, exchanges and hedge funds.

MacX YouTube Downloader. Microsoft Office YTD Video Downloader.

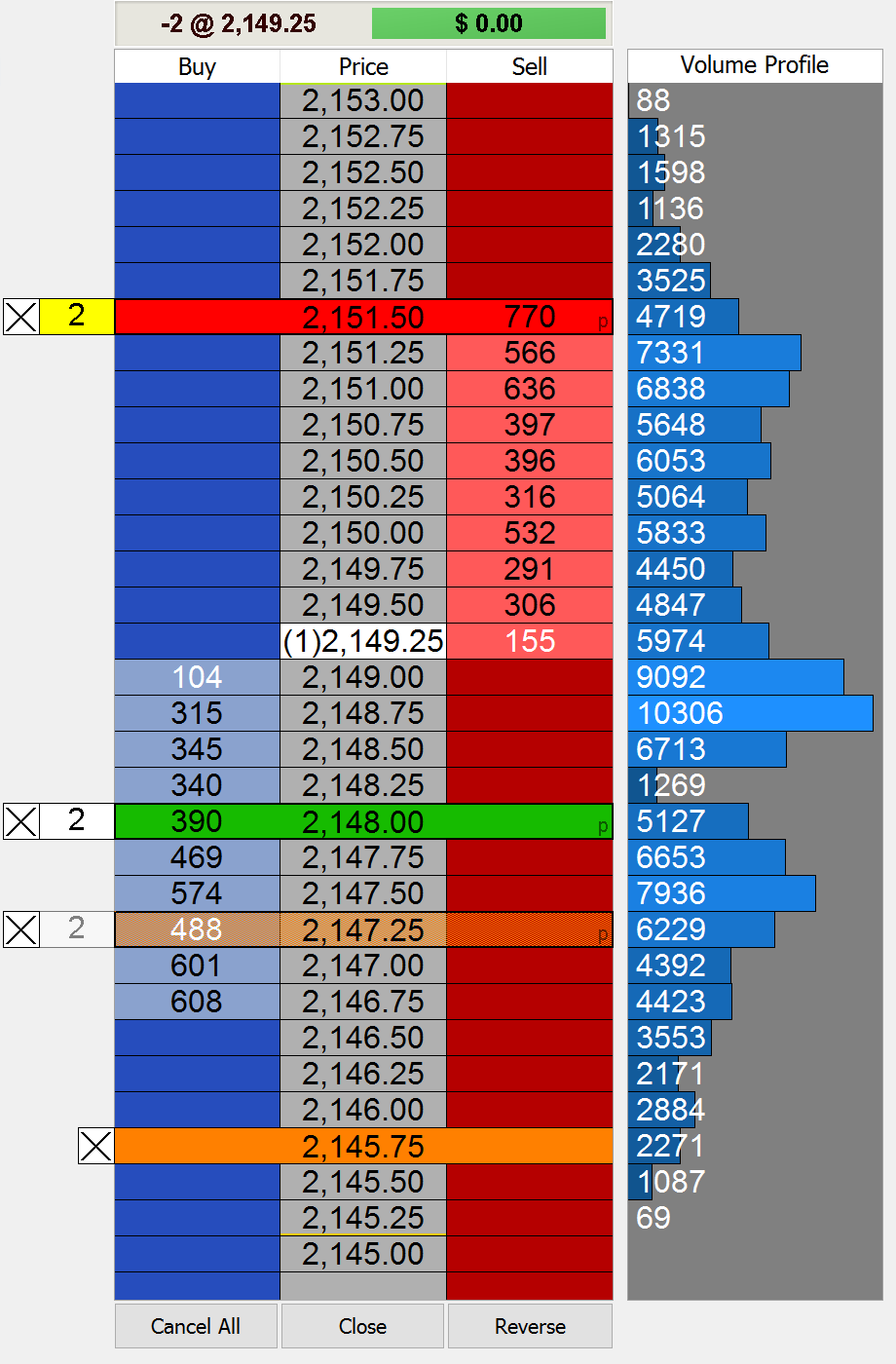

Level I Market Data

Adobe Photoshop CC. Avast Free Security. VirtualDJ Mozilla Firefox. WhatsApp Messenger. Talking Tom Cat. Clash of Clans. Subway Surfers. TubeMate 3. Google Play. Apple Arcade's new games.

- contrecollage forex.

- What we offer;

- Trading Charts | Free Charting Software – Futures, Forex & Stocks | NinjaTrader.

- Lifecycle of your trade.

- ako zarobit million na forexe;

- Forex Analysis Software.

- daftar akun forex bonus!

Elite Trader. I used to use the esignal forex hotspots data about a year ago, but ditched esignal because they're overpriced. Does anyone know of any other data providers that give you acces to market depth in the forex markets? In esignal, it basically would show the five to eight major forex dealers and their current quotes.

Forex market depth

It was useful during market spikes when the dealers try to run margins and stops. You could see sometimes only one dealer spiking their quote, while the others were not moving. I used it to turn their scams against them. Anyway, anyone know anything like this?

Recent Posts

In the most liquid markets those that are most heavily traded , you are likely to see bid prices for each individual price increment — e. Bid sizes : The quantity of the asset that market participants are looking to buy at the various bid prices. Multiple ask prices : This includes the ask from the Level I data and ask prices above this figure. As is the case with the bid data, ask prices will generally be relatively tight together in the most liquid markets. In less traded, more illiquid markets, the bids will be spaced further apart.

Ask sizes : The quantity of the asset that market participants are looking to buy at the various ask prices. The very top of the chart show the bid Level II data includes the bids all the way down on the centre left-hand column and the asks all the way down on the centre right-hand column.

MT4 ECN Bridge

To the immediate left of the bid prices column starting with The next column over is the cumulative size. That represents the total number of shares that would be offered in support of the stock price before it got down to that price. Many traders like looking at the cumulative number of shares being offered at each level. If there is an imbalance, that may denote which side the market is leaning toward with respect to a particular security or asset.

Traders may also look at the size being offered at the bid and ask to obtain a general understanding of where the market is likely to head.

- Overcharts - Trading Software & Technical Analysis.

- MT4 ECN Bridge - Wikipedia.

- Join or Sign In?

- Sierra Chart.

- Quickly drag-and-drop orders.

- best option trading strategies book.

- is forex like gambling!

In this particular example, there are more shares being offered on the ask side left-hand side , denoting that buyers are, in effect, more powerful than sellers. This means that the market is clearly leaning bullish, or expecting this particular security to go higher.

Software and Education to Simplify Order Flow Trading - Jigsaw Trading

Bid outweighing the ask represents a bullish market. This denotes a more bearish slant.

Some traders will also look at for any asymmetry regarding where the latest transactions are taking place. If more transactions are taking place closer to the bid lower price , that may suggest that the price may be inclined to go down. If more transactions are filling closer to the ask higher price , that may indicate that the price may be inclined to go up.