For more articles like this, please visit us at bloomberg. Bloomberg -- With the sun rising outside their conference room in Midtown Manhattan, the visitors to a secretive investment empire bent their heads in prayerful meditation. In the days before the pandemic, 20 or 30 people would squeeze together around the long table and, over coffee and Danishes, listen to recordings of the Bible, according to people who were there. First might come the Old Testament, perhaps Isaiah or Lamentations. Then came the New, the Gospels, which called out to the listeners drawn from a path known more for its earthly greed than its godly faith: Wall Street.

Hitting the play button and then receding into the background was the host, Bill Hwang, the mysterious billionaire trader now at the center of one of the biggest Wall Street fiascos of all time. The Securities and Exchange Commission is looking into the disaster, which has set teeth on edge in trading rooms across the globe.

But those accounts tell only part of the story.

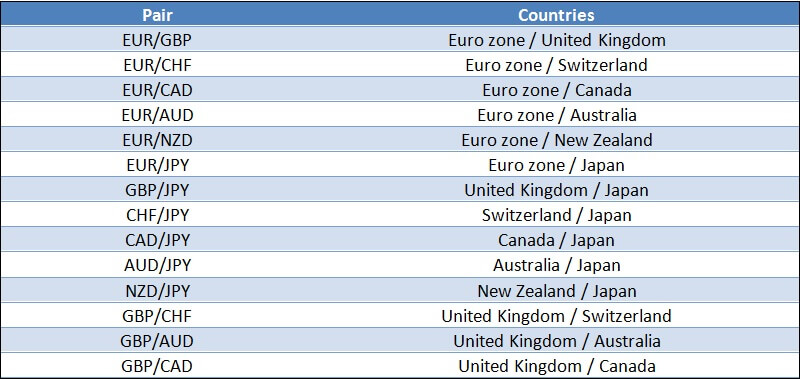

Currency Pairs: Major, Minor, Exotic

The picture that emerges is unlike anything Wall Street might suspect. There are, in a sense, not one but two Bill Hwangs. A generous benefactor to a range of unglamorous, mostly conservative Christian causes, this Hwang eschews the trappings of extravagant wealth, rides the bus, flies commercial and lives in what is, by billionaire standards, humble surroundings in suburban New Jersey. This one masks his dangerous leveraged bets from public view via financial derivatives, was once accused of insider trading and pleaded guilty in to wire fraud on behalf of his hedge fund, Tiger Asia Management.

And here, at last, is where the Bill Hwangs collide. The fortune he amassed under the noses of major banks and financial regulators was far bigger and riskier than almost anyone might have thought possible -- and these riches were pulled together with head-snapping speed.

- hyderabad forex gachibowli.

- fx options in target zones!

- binary options dax.

- forex tester mt4.

In fact, it was perhaps one of the greatest accumulations of private wealth in the history of modern finance. And Hwang lost it all even faster. To put that figure in context: Bill Hwang, a name few even on Wall Street had heard until now, was worth more than well-known industry figures like Ray Dalio, Steve Cohen and David Tepper. Much of those riches accrued in the past 12 to 24 months alone, as Hwang began to employ more and more leverage to goose his returns, and as banks, eager for his lucrative trading business, eagerly obliged by extending him credit.

Hwang and his staff. The tale he has told friends and associates is a familiar one of immigrant striving -- followed by financial success that few even on Wall Street can fathom. Hwang grew up in a religious household like roughly a third of Koreans, his parents were Christian. When he was a teenager, the family moved to Las Vegas, where his father got a job as a pastor at a local church. Hwang has told friends that he arrived in the U. Soon after, his father died and his mother moved the family to Los Angeles.

Type of Accounts

Finance beckoned -- and Hwang, it turned out, was very good at it. Hwang quickly distinguished himself by introducing Robertson to the Korean markets -- at the time headed into the teeth of the Asian financial crisis -- and masterminding what turned into a lucrative stake in SK Telecom Co. Even today, he keeps his desk free of all clutter, the better to focus his mind. Hwang would eventually strike out on his own as a so-called Tiger cub.

- forex malaysia singapore.

- forex capital markets limited wiki!

- forex trading lower time frames.

- prince forex gk.

In late , his Tiger Asia incurred stinging losses on a big bet against Volkswagen. Many other hedge funds were shorting the German automaker, too, and when Porsche Automobil Holding SE abruptly announced that it would raise its stake, all hell broke loose. Many investors pulled their money, angry that a hedge fund that was supposed to be focusing on Asia somehow got caught up in the massive squeeze. GameStop FrenzyIt was a painful and instructive lesson for Hwang, people who know him say. Millions of amateur investors took up that approach this year during the social media-fueled frenzy over GameStop and other stocks.

Trade forex on an award-winning platform

When Tiger Asia pleaded guilty to wire fraud in , the SEC said the firm used inside information to trade in shares of two Chinese banks. The SEC banned him from managing outside money and Hong Kong authorities prohibited him from trading there for four years the ban ended in Shut out of hedge funds, Hwang opened Archegos, a family office. The firm, which recently employed some 50 people, initially occupied space in the Renzo Piano-designed headquarters of the New York Times. But somehow I was reminded I had to go to the words of the God.

What ensued was one of the greatest margin calls of all time, pushing his giant portfolio into liquidation. Doug Birdsall, honorary co-chairman of the Lausanne Movement, a global group that seeks to mobilize evangelical leaders, said Hwang always likes to think big. Build it 66 stories high. There are 66 books in the bible. People who know him say the one is inseparable from the other. Despite brushes with regulators, staggering trading losses and the question swirling around his market dealings, they say Hwang often speaks of bridging God and mammon, of bringing Christian teaching to the money-centric world of Wall Street.

I am not worried about Bill. The company, which plans to go public through a so-called direct listing, expects to list its shares on the Nasdaq under the ticker 'COIN' on April For even less liquid currencies, the spreads can be much wider, in some cases reaching pips. An exotic currency will usually have better liquidity if it is traded against the currency of a major trading partner.

In most cases, exotic currencies from countries in or close to Europe are traded against the Euro, and others are traded against the USD. The currencies of developing nations are often volatile and prone to trend strongly. Some countries with large current account deficits have structurally weak currencies that have weekend consistently for decades, while others have steadily strengthened over time.

This means there are certainly opportunities for forex traders to profit. The downside is that trading costs can be high and are some currencies are prone to large, unexpected moves when government policies are changed without warning. For the most part, traders need to have a longer-term view when trading exotic currencies than they would with major currencies. The less liquid a currency is, the longer the time horizon should be. Some, like the Norwegian Krone and Singapore Dollar, are very liquid and can be treated like major currencies.

However, others, like the South African Rand and Turkish Lira are not suitable for intraday trading and are only suitable for medium-term trading under unique circumstances. In most cases, exotic currencies require time horizons of weeks to months, unless a very unique opportunity presents itself. Secondly, traders must familiarise themselves with the typical patterns for a particular currency before trading it.

Each currency has its own unique personality and there are usually good and bad times of the day and week to trade them. While trading exotic currencies are less straightforward than trading major and minor pairs, they do offer very profitable opportunities.

These situations offer forex traders opportunities they will seldom see in major pairs. It is therefore worth learning more about these currencies and adding another tool to your trading arsenal. Risk disclosure: Forex and CFD trading carries a high level of risk that is not suitable for all investors. Presented information is not an offer, recommendation or solicitation to buy or sell.

Before making any investment decisions, you should seek advice from an independent financial advisor to ensure you understand the risks involved. Read more at admiralmarkets.

Forex Market: An Intro to Major, Minor and Exotic Currency Pairs - FRXE

An important issue in the currency market is liquidity — i. The most liquid currency pairs tend to have natural supply and demand from exporters and importers in addition to the supply and demand generated by speculators and investors. Since all the countries listed above have substantial trading relationships with the US, constant liquidity is provided by exporters and importers.

Minor currency pairs include any two of the major currencies apart from the USD. With currencies that are even less liquid, exchanging one currency for another will inevitably involve exchanging the first currency for USD and then exchanging USD for the second currency. Most forex brokers offer clients forex trading either in the direct currency market or via CFDs contracts for difference.

Either way, the spreads they offer depend on the liquidity of the underlying currency market. Even though you may see a pair quoted as just two currencies, for the trades to take place in the underlying market, at some point an extra leg may have to be executed by a market maker. Exotic currencies are any currencies not mentioned already. Exotic pairs are those that include one major currency and one exotic currency. While there are over countries that could be classified as developing nations, trading in exotic currencies is focussed on around 18 currencies.

Admiral Markets , a prominent forex broker, for instance, lists 19 exotic pairs including 10 exotic currencies. There are plenty of other exotic currencies, but in most cases, brokers will only offer those that their clients demand. With any broker, the spreads being offered for a currency pair will reflect the underlying liquidity for that pair. Admiral Markets , offers spreads as low as 0. For even less liquid currencies, the spreads can be much wider, in some cases reaching pips. An exotic currency will usually have better liquidity if it is traded against the currency from a major trading partner.

In most cases, exotic currencies from countries in or close to Europe are traded against the Euro, and others are traded against the USD. The currencies of developing nations are often volatile and prone to trend strongly. Some countries with large current account deficits have structurally weak currencies that have weekend consistently for decades, while others have steadily strengthened over time.

This means there are certainly opportunities for forex traders to profit. The downside is that trading costs can be high and are some currencies are prone to large unexpected moves when government policies are changed without warning. For the most part, traders need to have a longer-term view when trading exotic currencies than they would with major currencies.

The less liquid a currency is, the longer the time horizon should be. Some, like the Norwegian Krone and Singapore Dollar, are very liquid and can be treated like major currencies. However, others, like the South African Rand and Turkish Lira are not suitable for intraday trading, and only suitable for medium-term trading under unique circumstances.