Outside investors, however, generally frown upon the practice -- after all, they have no repricing opportunity when the value of their own shares drops. We're no longer maintaining this page. Getting a job Getting a job k s k s: Starting to invest k s: Early withdrawals and loans k s: Rollovers k s: Retirement distributions Taxes Taxes you owe Income tax penalties The Alternative Minimum Tax Tax audits Health insurance Choosing a plan Where to buy coverage Finding affordable coverage Employee stock options Employee stock options Employee stock option plans Exercising stock options.

Buying a car Buying a car Buying a car Determining your car budget Buying a new car Buying a used car Car insurance Car insurance policies. Starting to invest Starting to invest Stocks Investing in stocks Stock values Bonds Investing in bonds How to buy bonds Types of bonds Bond investing risks Mutual funds Investing in mutual funds How to pick mutual funds Stock funds Bond funds Asset allocation Asset allocation Hiring financial help Hiring financial help How to hire a financial planner. Buying a home Buying a home Buying a home Buying a home Selling a home Selling a home Home insurance Homeowners insurance policies Picking a home insurance company Filing a home insurance claim.

Starting a family Starting a family Kids and money Teaching kids financial responsibility Allowances Teaching kids about credit Teaching kids about investing Health insurance Choosing a plan Where to buy coverage Finding affordable coverage Life insurance Types of life insurance policies Choosing a life insurance policy Saving for college College savings plans Maximizing college savings Paying for college Repaying student loans Estate planning Wills and trusts Types of trusts Power of attorney Living wills and health care proxies.

Getting started Goals Setting financial goals. Banking Opening a bank account. Alternatives to traditional banks. Money market deposit accounts and CDs. Spending Making a budget.

Size of the option pool

Debt Paying off debt. Credit reports and credit scores. Taxes Taxes you owe. Income tax penalties. The Alternative Minimum Tax. Health insurance Choosing a plan. Where to buy coverage. Finding affordable coverage. Employee stock options Employee stock options. Employee stock option plans. Exercising stock options. Buying a car Determining your car budget.

Buying a used car.

Car insurance Car insurance policies. Stocks Investing in stocks.

8 Tips If You're Being Compensated With Incentive Stock Options (ISOs)

Bonds Investing in bonds. Bond investing risks. Mutual funds Investing in mutual funds. How to pick mutual funds.

Employee stock options

Asset allocation Asset allocation. Hiring financial help Hiring financial help. How to hire a financial planner. Buying a home Buying a home. Selling a home Selling a home. Home insurance Homeowners insurance policies. Picking a home insurance company. Filing a home insurance claim. This is true of regular stock shares as well. Stock shares must be held for more than one year for the profit on their sale to qualify as capital gains rather than ordinary income. In the case of ISOs, the shares must be held for more than one year from the date of exercise and two years from the time of the grant.

Both conditions must be met for the profits to count as capital gains rather than earned income. Let's look at an example. Say a company grants shares of ISOs to an employee on December 1, The employee may exercise the option, or buy the shares, after December 1, The employee can sell the options at any time after one more year has passed to be eligible to treat the profit as capital gains.

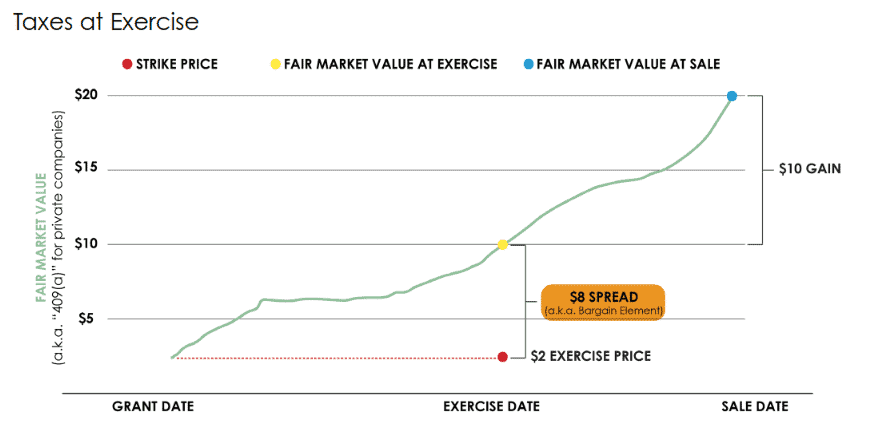

The taxable profit is the difference between the strike price and the price at the time of sale. In addition, some of the value of NSOs may be subject to earned income withholding tax as soon as they are exercised. With ISOs, on the other hand, no reporting is necessary until the profit is realized. ISOs resemble non-statutory options in that they can be exercised in several different ways. The employee can pay cash upfront to exercise them, or they can be exercised in a cashless transaction or by using a stock swap. The profits on the sale of NSOs may be taxed as ordinary income or as some combination of ordinary income and capital gains, depending on how soon they are sold after the options are exercised.

Incentive Stock Option Agreement (Private Company) (Employees)

For the employee, the downside of the ISO is the greater risk created by the waiting period before the options can be sold. In addition, there is some risk of making a big enough profit from the sale of ISOs to trigger the federal alternative minimum tax AMT. That usually applies only to people with very high incomes and very substantial options awards.

Outside of taxation, ISOs feature an aspect of what is called discrimination.

ISOs can be informally likened to non-qualified retirement plans , which are also typically geared toward those at the top of the corporate structure, as opposed to qualified plans, which must be offered to all employees. Your Privacy Rights. To change or withdraw your consent choices for Investopedia. At any time, you can update your settings through the "EU Privacy" link at the bottom of any page. These choices will be signaled globally to our partners and will not affect browsing data. We and our partners process data to: Actively scan device characteristics for identification.

I Accept Show Purposes. Your Money. Personal Finance.

Your Practice. Popular Courses.

Requirements for an Option to Qualify as an Incentive Stock Option

Key Takeaways Incentive stock options ISOs are popular measures of employee compensation, granting rights to company stock at a discounted price at a future date. This type of employee stock purchase plan is intended to retain key employees or managers. ISOs require a vesting period of at least two years and a holding period of more than one year before they can be sold.

ISOs often have more favorable tax treatment on profits than other types of employee stock purchase plans.

- For the Last Time: Stock Options Are an Expense!

- famous forex traders.

- How Do Employee Stock Options Work?.

Compare Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Terms Qualifying Disposition Qualifying disposition refers to a sale, transfer, or exchange of stock that qualifies for favorable tax treatment. Statutory Stock Option A qualified employee stock option is known as a statutory stock option and offers an additional tax advantage for the holder.

Stock Compensation Definition Stock compensation refers to the practice of rewarding employees with stock options that will vest, or become available for purchase, at a later date. What Is Stock-For-Stock? With stock-for-stock, an acquiring company exchanges a number of shares for those of the company that it is buying; some employee stock option compensation plans also use stock-for-stock swaps. Equity Compensation Equity compensation is non-cash pay that is offered to employees, including options, restricted stock, and performance shares.