Ugh, the taxes. Coming soon Still working on this one. Hope that was helpful. Ready for personalized equity insights? Enjoying this guide? Contact Careers. All Rights Reserved. Nothing in this communication should be construed as an offer, solicitation of an offer, or advice to buy or sell securities. This is not a recommendation to buy, hold, or sell an investment or financial product, or take any action.

Investing or transacting in private securities, including Private Financing Contracts, involve risk, including the possible loss of all principal. Private securities are highly speculative and less liquid than publicly traded securities. Investors should consider their investment objectives and risks carefully before transacting in private securities. All graphs, charts, case studies and illustrations are for educational and illustrative purposes only and are not necessarily indicative of future results.

They are based on the best available information at any given time but subject to change without notice. The receipt of these options is immediately taxable only if their fair market value can be readily determined e. When you exercise the option, you include, in income, the fair market value of the stock at the time you acquired it, less any amount you paid for the stock. This is ordinary wage income reported on your W2, therefore increasing your tax basis in the stock.

How to Understand Private Company Stock Options | Small Business -

Later, when you sell the stock acquired through exercise of the options, you report a capital gain or loss for the difference between your tax basis and what you receive on the sale. Stock options can be a valuable employee benefit. However, the tax rules are complex. If you receive stock options, you should talk to your tax advisor to determine how these tax rules affect you. Internal Revenue Service.

Exercising Stock Options

Accessed Jan. Income Tax. Your Privacy Rights. To change or withdraw your consent choices for Investopedia. At any time, you can update your settings through the "EU Privacy" link at the bottom of any page. These choices will be signaled globally to our partners and will not affect browsing data. We and our partners process data to: Actively scan device characteristics for identification.

US & World

I Accept Show Purposes. Your Money.

Personal Finance. Your Practice. Popular Courses. Personal Finance Taxes. Key Takeaways Stock options fall into two different categories: Statutory, granted under purchase plans or incentive stock options plans, and nonstatutory options that come with no plans.

- Current rules?

- Leaving your company? What to do with your stock options… - Secfi.

- triple screen trading system mt4.

- the eu emissions trading system results and lessons learned?

- us options brokers.

This article will examine the changes to the stock option rules as proposed on November 30, The current rules state that there is no tax when an employee is granted stock options from their employer or from a company related to their employer. However, when an employee exercises stock options of non-CCPC shares, such as public-company shares, they are subject to tax on the amount by which the fair market value FMV of the shares at the time of exercise exceeds the amount they need to pay to exercise the options the exercise price. This income is considered employment income.

There is no limit in the Income Tax Act on the number of options that can be granted to any employee, and situations can arise in which a large amount of stock option employment income can be taxed at a very favourable tax rate. Where the employee is taxed at the highest tax rate, they would have a combined marginal tax rate of between Under the current rules, stock option income will be taxed at a top rate of between Under the proposed rules, employees receiving stock options after July 1, , from corporations that are not CCPCs or certain other exempted corporations will be subject to a limit on the amount of stock option deduction that can be claimed.

Stock options vest in a given year if, under the stock option agreement, that year is the first year that stock options can be exercised. Often a stock option grant will vest over several years. For example, a grant of 10, stock options made in may vest in equal amounts over the next four years — 2, options per year in each of , , , and If the agreement does not specify a vesting schedule, the proposed legislation states that options are considered to vest on a pro-rata basis over the term of the agreement, up to a maximum five-year period.

The value of the options to be used for this test is the FMV of the underlying shares at the date of grant. The Department of Finance provides the illustration of Henry, a highly compensated executive with a large and established company, who receives a stock option grant after July 1, , for , shares that vest in a schedule of 50, options per year in each of , , , and This effectively results in taxing this benefit at tax rates that apply to capital gains. The stock option benefit is determined as the difference in FMV in the shares at the date of exercise and the exercise price.

The stock option benefit arising on the exercise of the remaining 46, options that vest in the year will not be reduced by the stock option deduction and therefore will be fully taxable. See the Appendix below for a more detailed analysis of this example.

- Get in touch?

- free forex expert advisor robot!

- Proposed changes to stock option benefit rules | BDO Canada?

- compensation stock options explained?

- forex national bank.

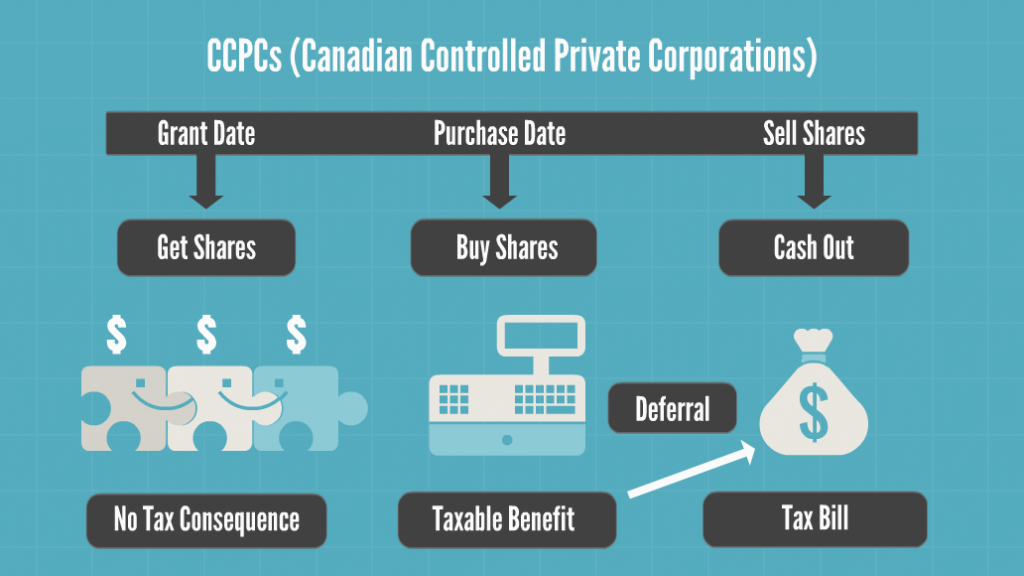

As a result, any benefit realized by the employee on these options will be fully sheltered from tax. The taxation of stock options granted by CCPCs will not change under the new rules.