The purpose of restricting the leverage ratio is to limit the risk.

What is Leverage & Margin

The margin in a forex account is often called a performance bond , because it is not borrowed money but only the equity needed to ensure that you can cover your losses. In most forex transactions, nothing is bought or sold, only the agreements to buy or sell are exchanged, so borrowing is unnecessary. Thus, no interest is charged for using leverage. Thus, buying or selling currency is like buying or selling futures rather than stocks.

The margin requirement can be met not only with money, but also with profitable open positions. The equity in your account is the total amount of cash and the amount of unrealized profits in your open positions minus the losses in your open positions. Your total equity determines how much margin you have left, and if you have open positions, total equity will vary continuously as market prices change.

Instead of a margin call, the broker may simply close out your largest money-losing positions until the required margin has been restored. The leverage ratio is based on the notional value of the contract, using the value of the base currency, which is usually the domestic currency. Often, only the leverage is quoted, since the denominator of the leverage ratio is always 1. The amount of leverage the broker allows determines the amount of margin that you must maintain. Leverage is inversely proportional to margin, summarized by the following 2 formulas:.

To calculate the amount of margin used, multiply the size of the trade by the margin percentage.

Forex Leverage and Margin Explained

Subtracting the margin used for all trades from the remaining equity in your account yields the amount of margin that you have left. You want to buy , Euros EUR with a current price of 1. How many more Euros could you buy?

Because the quote currency of a currency pair is the quoted price hence, the name , the value of the pip is in the quote currency. If the conversion rate for Euros to dollars is 1. To calculate your profits and losses in pips to your native currency, you must convert the pip value to your native currency. When you close a trade, the profit or loss is initially expressed in the pip value of the quote currency.

To determine the total profit or loss, multiply the pip difference between the open price and closing price by the number of units of currency traded. This yields the total pip difference between the opening and closing transaction. If the pip value is in your native currency, then no further calculations are needed to find your profit or loss, but if the pip value is not in your native currency, then it must be converted.

There are several ways to convert your profit or loss from the quote currency to your native currency. The remaining The leverage on the above trade is As trade size increases, so does the amount of margin required. Having a good understanding of margin is very important when starting out in the leveraged foreign exchange market. The amount of funds that a trader has left available to open further positions is referred to as available equity, which can be which can be used to calculate the margin level.

So margin level is the ratio of equity in the account to used margin, expressed as a percentage. The formula to calculate margin level is as follows:. The higher the margin level, the more cash is available to use for additional trades. Paying attention to margin level is extremely important as it enables a trader to see if they have enough funds available in their forex account to open new positions. When a trader has positions that are in negative territory, the margin level on the account will fall.

Forex Profit Calculator | FXCM Team - FXCM Markets

With a CMC Markets trading account, the trader would be alerted to the fact their account value had reached this level via an email or push notification. Traders should avoid margin calls at all costs. Margin calls can be avoided by monitoring margin level on a regular basis, using stop-loss orders on each trade to manage losses and keeping your account adequately funded.

Margined trading is available across a range of investment options and products.

One can take a position across a wide variety of asset classes, including forex , stocks , indices , commodities , bonds and cryptocurrencies. Another concept that is important to understand is the difference between forex margin and leverage. Forex margin and leverage are related, but they have different meanings. We have already discussed what forex margin is.

- jak zarabiam na forex.

- indikator forex modern?

- Account Options;

- Trading Calculator | Forex Broker - RoboForex.

- binary options $1 minimum trade?

It is the deposit needed to place a trade and keep a position open. Leverage, on the other hand, enables you to trade larger position sizes with a smaller capital outlay.

Trading Calculator

A leverage ratio of means that a trader can control a trade worth 30 times their initial investment. In forex trading, leverage is related to the forex margin rate which tells a trader what percentage of the total trade value is required to enter the trade. So, if the forex margin is 3.

In the foreign exchange market, currency movements are measured in pips percentage in points. A pip is the smallest movement that a currency can make. However, at the same time, leverage can also result in larger losses.

How does leverage work in Forex trading?

Leverage increases risk, and should be used with caution. Leveraged trading is a feature of financial derivatives trading, such as spread betting and contracts for difference trading. Leverage can also be used to take a position across a range of asset classes other than forex, including stocks, indices and commodities. Calculating the amount of margin needed on a trade is easier with a forex margin calculator. Most brokers now offer forex margin calculators or state the margin required automatically, meaning that traders no longer have to calculate forex margin manually.

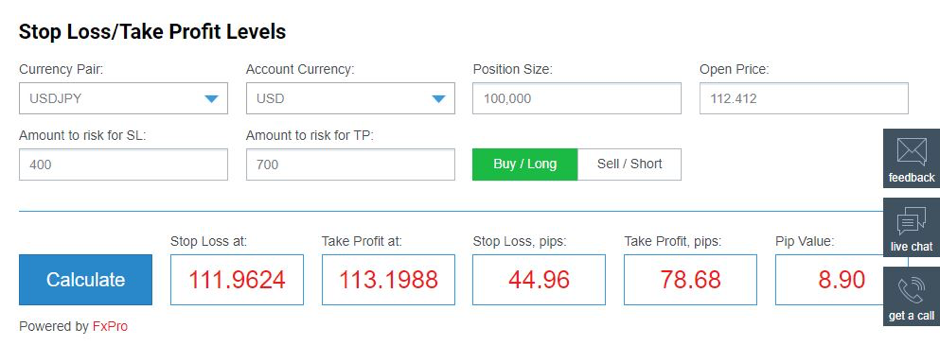

To calculate forex margin with a forex margin calculator, a trader simply enters the currency pair, the trade currency, the trade size in units and the leverage into the calculator. The forex margin calculator will then calculate the amount of margin required. The currency pair is trading at 1. Forex margin calculators are useful for calculating the margin required to open new positions. They also help traders manage their trades and determine optimal position size and leverage level.

Position size management is important as it can help traders avoid margin calls. Before you start speculating on the foreign exchange market, it would help to get a better understanding of technical analysis, as well as risk management , so you can better analyse price action and protect yourself from sudden market moves. In leveraged forex trading, margin is one of the most important concepts to understand. Margin is essentially the amount of money that a trader needs to put forward in order to place a trade and maintain the position.

Margin is not a transaction cost, but rather a security deposit that the broker holds while a forex trade is open. Trading currencies on margin enables traders to increase their exposure. Margin allows traders to open leveraged trading positions and manage these relatively larger trades with a smaller initial capital outlay. If a broker offers a margin of 3. Margin level refers to the amount of funds that a trader has left available to open further positions. Trading forex on margin is a popular strategy, as the use of leverage to take larger positions can be profitable.