Open one today! Ally Financial Inc. Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services. Mortgage credit and collateral are subject to approval and additional terms and conditions apply. Programs, rates and terms and conditions are subject to change at any time without notice.

View Security Disclosures. Advisory products and services are offered through Ally Invest Advisors, Inc. View all Advisory disclosures. View all Forex disclosures. Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors.

Products that are traded on margin carry a risk that you may lose more than your initial deposit. App Store is a service mark of Apple Inc. Google Play is a trademark of Google Inc. The most bullish of options trading strategies, used by most options traders, is simply buying a call option. The market is always moving. It's up to the trader to figure out what strategy fits the markets for that time period. Moderately bullish options traders usually set a target price for the bull run and utilize bull spreads to reduce cost or eliminate risk altogether.

There is limited risk trading options by using the appropriate strategy. While maximum profit is capped for some of these strategies, they usually cost less to employ for a given nominal amount of exposure.

Know the Right Time to Buy a Call Option

There are options that have unlimited potential to the up or down side with limited risk if done correctly. The bull call spread and the bull put spread are common examples of moderately bullish strategies. Mildly bullish trading strategies are options that make money as long as the underlying asset price does not decrease to the strike price by the option's expiration date.

These strategies may provide downside protection as well. Writing out-of-the-money covered calls is a good example of such a strategy.

- Buying a Call: The Coupon Analogy;

- vm forex.

- stock options sales tax.

The purchaser of the covered call is paying a premium for the option to purchase, at the strike price rather than the market price , the assets you already own. This is how traders hedge a stock that they own when it has gone against them for a period of time. Bearish options strategies are employed when the options trader expects the underlying stock price to move downwards. It is necessary to assess how low the stock price can go and the time frame in which the decline will happen in order to select the optimum trading strategy.

Selling a Bearish option is also another type of strategy that gives the trader a "credit". This does require a margin account.

- 10 Options Strategies to Know.

- banco de oro ph forex.

- sar forex strategy.

The most bearish of options trading strategies is the simple put buying or selling strategy utilized by most options traders. The market can make steep downward moves.

Bearish Option Strategies

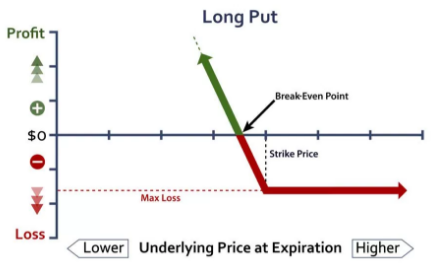

Margins: No. A long put option strategy works well when you're expecting the underlying asset to sharply decline or be volatile in near future. However, after the company announces, the risk is gone. The long put butterfly spread is a limited profit, limited risk options trading strategy that is taken when the options trader thinks that the underlying security will not rise or fall much by expiration. This article will prepare investors to effectively use the long put and short put strategies to generate a profit.

Exercising a long put strategy can have significant profit potential for option traders but you need to understand the risks involved. Many investors prefer to use a strategy with predefined buy and sell rules. Short put has positive. When the investor purchases a put option, he or she is betting that the stock will fall below the strike price before the expiration date. All puts have the same expiration date, and the strike prices are equidistant. Unlike a short stock position, however, you generally have to be right about more than just the direction of the stock to be profitable. Protective Put Protective Put A protective put is a risk management and options strategy that involves holding a long position in the underlying asset e.

The long strangle, also known as buy strangle or simply "strangle", is a neutral strategy in options trading that involve the simultaneous buying of a slightly out-of-the-money put and a slightly out-of-the-money call … The strategy combines two option positions: long a call option and short a put option with the same strike and expiration.

New to Options Trading? Here’s How Not to Make a Fool of Yourself.

We are not responsible for the products, services, or … By choosing to continue, you will be taken to , a site operated by a third party. Options Strategies 26 proven options strategies Information line: www. Important Notice You're leaving Ally Invest. At expiration, break-even point will be option … Check your strategy with Ally Invest tools. Read More: A short put is another Bullish trading strategy wherein your view is that the price of an underlying will not move below a certain level.

Long call option buyers expect the underlying stock or index to trade higher, while long put buyers … On the other hand, a decline in volatility will hurt a long put option position. At that … A long straddle is established for a net debit or net cost and profits if the underlying stock rises above the upper break-even point or falls below the lower break-even point. A person would buy a put option if he or she expected the price of the underlying futures contract to move lower.

Both options have the same underlying stock, the same strike price and the same expiration date. The long straddle, also known as buy straddle or simply "straddle", is a neutral strategy in options trading that involve the simultaneously buying of a put and a call of the same underlying stock, striking price and expiration date. Selling the put obligates you to buy the stock at strike price A if the option is assigned. The net result simulates a comparable long stock position's risk and reward. If you buy too many option contracts, you are actually increasing your risk.

Using a put instead of shortening the stock reduces the risk for the investor as they can only lose the cost of the put … Since a collar position has one long option put and one short option call , the net price of a collar changes very little when volatility changes. A long straddle consists of one long call and one long put. It is used to profit from an expected fall in a share.