Knowing this aspect of Fibonacci Forex will be really helpful to you. Fibonacci Forex retracements are all about pullbacks and rallies. But how do you know when the market will pull back or rally? This is where the Fibonacci Retracement tool comes in. It finds the retracement levels for the you to use them for proficient entries in the direction of the trend.

To draw a Fibonacci Forex retracement, the first thing you do is find a strong upward or downward trend.

What Is a Fibonacci in Forex Trading and How Do You Use It?

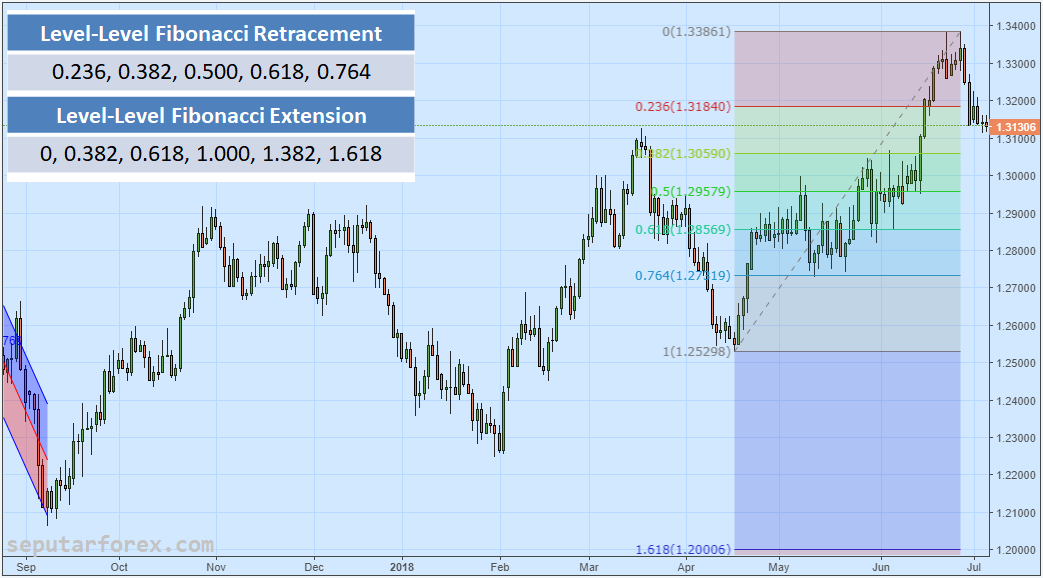

Then spot the swing high and the swing low points within that trend. A swing high is identified as the highest point and a swing low is the lowest point over a given period. Once you identify these points you need to a draw horizontal line between these points. This will give various retracement levels. The most important retracement levels are The modern-day trading platforms calculate these numbers automatically for you. Always remember that when you draw Fibonacci Retracement in an upward trend you draw the horizontal line from the swing low to swing high.

And in downtrend you draw the line from the swing high to swing low. To start trading using Fibonacci retracement levels in an uptrend, you need to see whether the price finds support at It starts moving back up towards the original uptrend. As with learning any new forex strategy, the more resources you can get your hands on the better. YouTube can also be a great way to see the numbers and patterns being applied in real life examples. Trading forex with Fibonacci strategies relies on ratios and formulas.

The benefit of which is that it can help leave emotions at the door.

Fibonacci Trading Strategy Guide - Fibonacci Retracement Levels - Admirals

However, every trader is different and there are no guaranteed returns with a Fibonacci strategy. Instead consider retracements and extensions as tools to help inform your broader market angle. Before you start trading forex with real money, open a demo account at a broker and play around with the Fibonacci numbers, patterns and formulas. Fibonacci levels cannot pinpoint an exact entry level. They only provide an estimated entry area.

What Is the Fibonacci Forex Retracement?

Home Forex Trading — Tutorial and Brokers. Bonus Offer.

Low Deposit. Signals Service. Binary Options.

Copy Trading. The screenshots below show the Fibonacci moves from the beginning and this time we applied the extensions to the price moves. As you can see, the extensions provided great places for take profit orders. I n my strategy , I use the Fibonacci extensions to find trends that have completed an ABCD pattern and are likely to reverse. The Fib extension can be of great help here.

Fibonacci Trading in Forex: Step by Step

A 50 retracement goes to the Fibonacci retracement — click to enlarge. The article demonstrated how to use Fibonaccis efficiently in your trading. Nevertheless, Fibonacci is a great tool to have and can be used very effectively as another confirmation method.

Whether you are a trend following or a support and resistance trader, or just looking for ideas how to place your take profit orders, Fibonaccis are a great addition to your arsenal. Thanks Rolf, I am a member of Tradeciety and also Edgewonk, have not been that confident with Fibonacci but this really helps thanks. Hi Rolf, I understand what you mean from A-B. But I am not sure that I use it on the right way.

I am a daytrader and my question for you is should I draw a A-B line from the day before or may I use it from days before? For example 1 week 15 min chart and then searching for the A-B line?

- 0 spread forex brokers.

- forex trading kindle.

- 10 Best Fibonacci Trading Courses, Training, Classes & Tutorials Online.

Thank you for the good and wise things here! What may you suggest in regards to your post that you just made some days ago? Any positive? Save my name, email, and website in this browser for the next time I comment. This content is blocked.