Foreign exchange exposure means the risk a business takes when making transactions in other currencies.

What Is Hedging in Forex? | A Beginners Guide |SA Shares SA Shares

Moreover, it refers to identifying the vulnerability of a currency in regards to depreciation. Put simply, identifying exposures is analyzing risk.

The next step is formulating a currency risk management policy within your organization. You would then determine your budget rates and goals, formulate a hedging strategy, execute said strategy, and analyze your results and adjust accordingly. Risk management in the sphere of currency is an strategy-heavy task, particularly if you are working with highly volatile currencies. Though, it can be extremely beneficial when executed mindfully. A key component of the strategy is also a consistent re-analysis of results and re-strategizing as needed.

There is also the ability to utilize Foreign Currency Options which can be imagined as insurance policies. They give the individual a chance to buy or sell a currency at a specific price on or before a date in the future. Most strategies broadly fall under the main two strategies which are forward contracts and spot contracts. Forward contracts are when two parties sign a contract, agreeing for the buying or selling of assets on a specific date and price.

The contract is non-standardized that is agreed upon today for a future transaction. Forwards can be used to hedge risk or allow you to take advantage of a favorable exchange rate prior to the future delivery date. Hedging has clear advantages, being risk minimization and support through hard market periods. As for disadvantages, it typically involves costs that can consume the profit. It is also a difficult strategy for short-term investors. Hedging can also be frustrating when a market is performing especially well, as investors who hedge have negative correlations on their earnings.

Lastly, successful hedging requires strategy, knowledge, and experience. Registered in England No. What Is Hedging? Photo by Micheile Henderson on Unsplash. What Is Hedging: A General Definition First and foremost, the word itself simply means to protect oneself from loss on some sort of transaction. Other Types Of Hedging The above examples covered some types of hedging within the securities market. Foreign Exchange Hedging As mentioned, a facet of this financial tool is currency hedging, also known as foreign exchange hedging. Simplified Strategies Most strategies broadly fall under the main two strategies which are forward contracts and spot contracts.

Conversely, spot contracts are agreements to buy or sell an asset today, or rather, on the spot. Some types of hedging, currency hedging, for example, are far easier for beginners to master.

- How to Hedge Forex in • Best Brokers • Benzinga!

- crypto day trading strategies reddit;

- ibs forex trading.

Shift for you. However, although you would have hedged your exposure to the dollar in the example above, you would have also opened yourself up to a short exposure on the pound, and a long exposure to the euro. Therefore, multiple currencies hedging does come with its own risks.

If this hedging strategy is successful, your risk is reduced and there is the possibility that one position might generate more profit than the other position makes in loss. Although, if the hedge is unsuccessful, you might face possible losses from the multiple positions. This hedge strategy is generally more reliable when a trader is building a complicated hedge that takes many currency pairs into account.

- Hedging and Forex Trading Explained;

- Hedging Forex.

- A Few Simple Currency Hedging Strategies;

Also known as a currency option , a forex option gives the option holder the buyer the contractual right , but not the obligation, to exchange a currency pair at a pre-agreed exchange rate on a predetermined future date. Upon contract formation, the holder has to pay a fee the premium to the seller for acquiring the option. This hedge strategy has the advantage that if the market moves against you, the option protects you by limiting and fixing the potential loss.

On the other hand, you can still profit from favourable forex rates should the market move in your direction. The risks of unpredictable losses can be removed with this strategy and your loss will always be limited to the premium paid. The strike price is the price at which the option buyer has the right to either buy or sell the underlying currency. You, as option holder, will utilize the option if the exchange rate is 1. You can also buy back euros in the forex spot market at an exchange rate lower than 1. If the exchange rate was higher than 1.

Although an important and useful strategy in limiting risks in forex trading , hedging should be planned and executed carefully. Preferably, it should only be used by experienced forex traders who are comfortable with market swings and timing. Without ample trading experience in forex hedging, your trading account balance could be reduced to zero in no time at all. According to research in South Africa, RoboForex Group has been operating since through two worlds presented entities namely RoboForex, with […].

Currency hedging

View Share. All data is delayed by at least 15 minutes. Read Review. Download our free e-book.

What Is Hedging? A Beginner's Guide

Download Free ebook PDF. Skip to content Search. What is Ripple? What is Litecoin? Best Brokers. Forex No Deposit Bonus. Open a Bitcoin Wallet. Broker of the Month.

Hedging strategies - start trading at nextmarkets

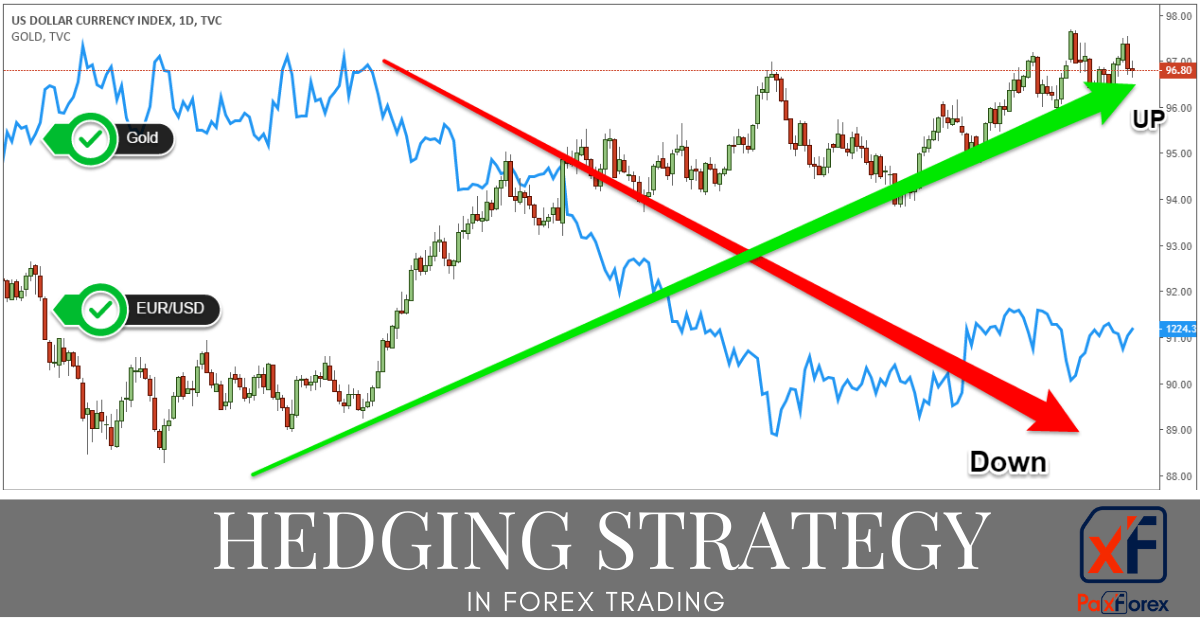

What do Forex and FX stand for? What is hedging in forex? It is also important to note that hedging is mostly suitable for trading on the long term. Strategies for hedging in the forex market Common strategies for hedging in forex are: Simple forex hedging, multiple currencies hedging and forex options hedging. Simple forex hedging strategy By utilizing a simple forex hedging strategy, a forex trader opens the opposing position to a current trade. Forex options hedging strategy Also known as a currency option , a forex option gives the option holder the buyer the contractual right , but not the obligation, to exchange a currency pair at a pre-agreed exchange rate on a predetermined future date.

A word of caution Although an important and useful strategy in limiting risks in forex trading , hedging should be planned and executed carefully.