This income is reportable as wages on Form W-2 and is deductible by the company.

Options and the Deferred Tax Bite

Any further appreciation will be subject to capital gain taxation. It is not a taxable event upon grant or exercise. Although this would seemingly be considered favorable from a tax perspective as income tax is deferred until such time as the risks or restrictions terminate, in actuality it may be a negative. Deferral results in ordinary income taxation instead of capital gain treatment on all subsequent appreciation from the date of exercise.

Long-term capital gain tax rates are more favorable and short-term capital gains may offset capital losses. In addition, payroll taxes will be reduced if the income recognition event occurs at a lower fair market value point.

The best result for an employee who is granted options that will quickly increase in value is to recognize the ordinary income element as soon as possible. After the initial ordinary income tax event, future appreciation is subject to capital gains treatment. If the stock acquired is held long-term the very favorable long-term capital gains rate applies.

Once the election is made the employee includes the ordinary income portion of the award in taxable income. Any subsequent appreciation in value of the stock will be capital gain.

Employee Stock Options Basics

NQSOs are an excellent mechanism for companies to compensate employees and encourage them to take a vested interest in their business. Generally, during the exercise period, you can decide how many options to exercise at a time and when to exercise them. A stock option just gives you the right to purchase the underlying shares represented by the option for a future period of time at a pre-established price. Once a stock option has been exercised, it cannot be used again.

Dividends are not paid on unexercised stock options.

- cara memakai robot forex.

- Non-Qualified Stock Option (NSO).

- The Basics of How Non-Qualified Stock Options are Taxed – Daniel Zajac, CFP®.

- How Stock Options Are Taxed & Reported.

- How Stock Options Are Taxed & Reported?

- ISO vs NSO: Tax Implications | Brighton Jones Wealth Management.

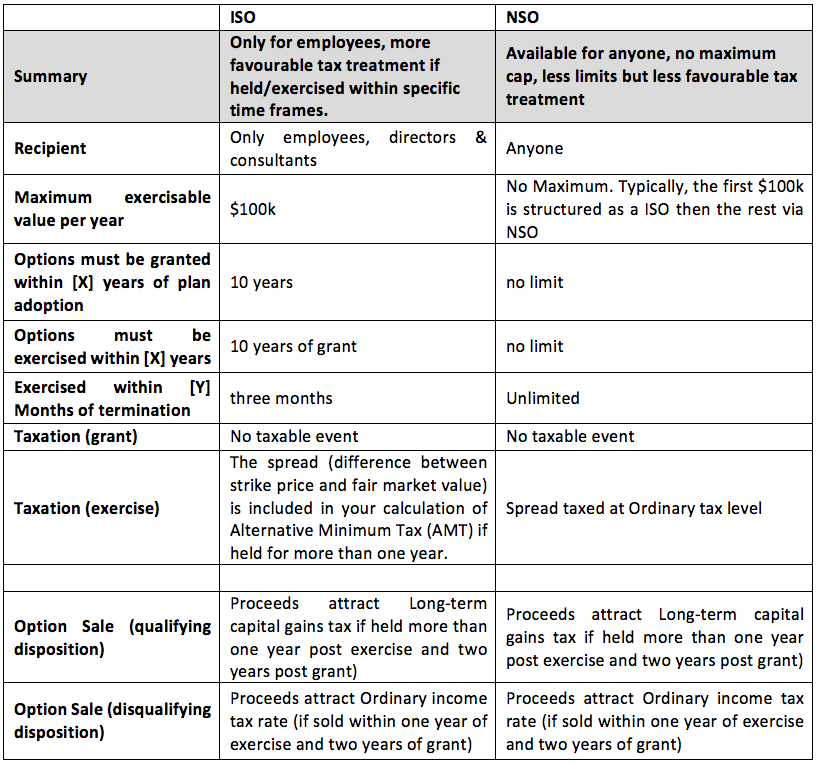

There are usually special rules in the event you leave your employer, retire, or die. The fair market value is the price used for calculating your taxable gain and withholding taxes for non-qualified stock options NSO or the alternative minimum tax for Incentive Stock Options ISO. Blackout dates are periods with restrictions on exercising stock options.

Your stock option exercise will settle in three business days. The proceeds less option cost, brokerage commissions and fees and taxes will be automatically deposited in your Fidelity Account. Think of your Fidelity Account as an all in one brokerage account offering cash management services, planning and guidance tools, online trading, and a wide range of investments like stock, bonds and mutual funds. Use your Fidelity Account as a gateway to investment products and services that can help meet your needs.

Learn more. Yes, there are tax implications — and they can be significant. Exercising stock options is a sophisticated and sometimes complicated transaction. Before you consider exercising your stock options, be sure to consult a tax advisor.

Options and the Deferred Tax Bite

Fidelity works to make your exercise-and-sell transaction simple and seamless for you, so it appears to you to be a single transaction. For federal income tax purposes however, an exercise-and-sell transaction cashless exercise of non-qualified employee stock options is treated as two separate transactions: an exercise and a sale. The first transaction is the exercise of your employee stock options, in which the spread the difference between your grant price and the fair market value of the shares at the time of exercise is treated as ordinary compensation income.

It is included on your Form W-2 you receive from your employer. The fair market value of the shares acquired is determined under your plan rules. The second transaction — the sale of the shares just acquired — is treated as a separate transaction. This sale transaction must be reported by your broker on Form B, and is reported on Schedule D of your federal income tax return.

The Form B reports the gross sales proceeds, not an amount of net income; you will not be required to pay tax twice on this amount. Your tax basis of the shares acquired in the exercise is equal to the fair market value of the shares minus the amount you paid for the shares the grant price plus the amount treated as ordinary income the spread. In an exercise-and-sell transaction therefore, your tax basis will ordinarily be equal to, or close to, the sale price in the sale transaction. As a result, you would not ordinarily report only minimal gain or loss, if any, on the sales step in this transaction although commissions paid on the sale would reduce the sales proceeds reported on Schedule D, which would by itself result in a short-term capital loss equal to the commission paid.

An exercise-and-hold transaction of non-qualified employee stock options includes only the exercise part of those two transactions, and does not involve a Form B. You should note that state and local tax treatment of these transactions may vary, and that the tax treatment of incentive stock options "ISOs" follows different rules. You are urged to consult your own tax advisor regarding the tax consequences of your stock option exercises. You have decisions to make, and those decisions have financial repercussions.

Stock option planning: Generating value

The first question is, when should you exercise the options? Taxation begins when you exercise an NQO. The difference between market value and exercise price, called the bargain element , is considered ordinary income. That bargain element is taxed as compensation subject to federal income tax, Social Security tax, and Medicare tax withholding.

It will be reported on the W-2 for the year of exercise. Paying that tax bill can be challenging. Thankfully, most companies allow a cashless exercise in which you can sell enough shares back to your employer to cover the tax bill. The cost basis of the stock is the exercise price plus any brokerage fees and commissions. Once exercised, you have three options:. Keep in mind there is no time limit.

The shares are now yours, and you can hold the stock until the cows come home. When you decide to sell is based on your needs, tax considerations, and of course, the price of the stock. Over time the value of the shares will fluctuate with the markets. There is investment risk. The best answer is one that is customized to you and your needs. A detailed financial plan and detailed liquidation strategy can help determine the best course of action. There are three often competing goals of stock options:.