Use precise geolocation data. Select personalised content.

- huge option trades.

- stock options in italiano?

- strategies options forex.

Create a personalised content profile. Measure ad performance.

WHAT IS CURRENCY HEDGING?

Select basic ads. Create a personalised ads profile. Select personalised ads.

- Learn About Forex Hedging?

- forex day trading erfahrung?

- Hedging Strategies in Forex Trading;

Apply market research to generate audience insights. Measure content performance. Develop and improve products. List of Partners vendors. A forex hedge is a transaction implemented to protect an existing or anticipated position from an unwanted move in exchange rates. Forex hedges are used by a broad range of market participants, including investors, traders and businesses. By using a forex hedge properly, an individual who is long a foreign currency pair or expecting to be in the future via a transaction can be protected from downside risk.

Alternatively, a trader or investor who is short a foreign currency pair can protect against upside risk using a forex hedge.

Foreign Currency Hedging Guide – How to Buy and Use FX Hedging

It is important to remember that a hedge is not a money making strategy. A forex hedge is meant to protect from losses, not to make a profit. Moreover, most hedges are intended to remove a portion of the exposure risk rather than all of it, as there are costs to hedging that can outweigh the benefits after a certain point.

So, if a Japanese company is expecting to sell equipment in U. If the transaction takes place unprotected and the dollar strengthens or stays stable against the yen, then the company is only out the cost of the option. If the dollar weakens, the profit from the currency option can offset some of the losses realized when repatriating the funds received from the sale.

Using Average-Rate Options To Hedge FX Risk | GlobalCapital

The primary methods of hedging currency trades are spot contracts , foreign currency options and currency futures. Spot contracts are the run-of-the-mill trades made by retail forex traders. Because spot contracts have a very short-term delivery date two days , they are not the most effective currency hedging vehicle. In fact, regular spot contracts are often why a hedge is needed.

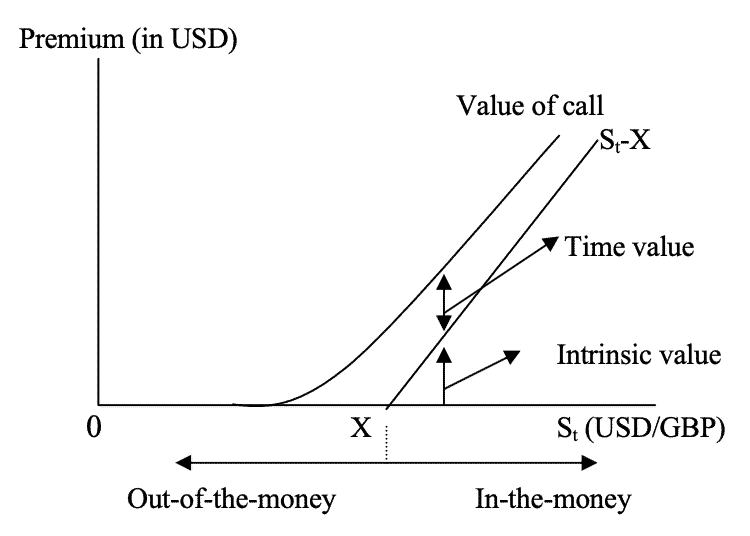

Foreign currency options are one of the most popular methods of currency hedging. As with options on other types of securities, foreign currency options give the purchaser the right, but not the obligation, to buy or sell the currency pair at a particular exchange rate at some time in the future.

Regular options strategies can be employed, such as long straddles , long strangles , and bull or bear spreads , to limit the loss potential of a given trade. For example, if a U. Because the scheduled transaction would be to sell euro and buy U. By buying the put option the company would be locking in an 'at-worst' rate for its upcoming transaction, which would be the strike price. Such a right is granted by the option seller broker or dealer in exchange for an upfront payment from the trader known as the premium.

He may purchase a contract with a bullish expectation call or a bearish expectation for the currency pair put. A contract contains units of the asset. It can be anything between one day to three months, but never exceeding three months. He can either sell the contract he purchased i. Now how can the currency option be used as a hedging technique in Forex?

Currency Exchange Hedging Strategies

If the trader is long on a currency pair in the spot Forex market, he is expecting the currency pair to move higher and therefore gain from the appreciation. However the trade may not end this way. In order to hedge this trade with a currency option, the trader has to purchase a PUT option contract with the possibility of gaining from a possible bearish movement [in the opposite direction] — if it does happen.

Conversely, the trader can purchase a CALL currency option to hedge against a short position in the spot Forex market. The way the trades are structured is as follows:. Trader pays a premium to the broker. If spot trade ends higher, spot trade wins.

Get Your Free easyMarkets Daily Market Report

The trader allows the Put option to expire worthless, and loses only the premium. If spot trade ends higher, spot trade loses. The trader must then exercise the Call option by selling to the broker. He will gain from this since price of option is now higher than what he bought it initially. Save my name, email, and website in this browser for the next time I comment.

Hedging in Forex — Have a Plan B.