I will not explain how to calculate these candlesticks here because MT4 does it all automatically for you and you do not have to worry about how those candles are drawn. Here I will tell you how to use Heiken Ashi in trading the trends. You can see an example Heiken Ashi chart:. As you see, the white bodies are the uptrend candles, and the red bodies are the downtrend candles.

The upper shadows are usually absent on the downtrends, while the lower shadows are absent when the trend is going up. There are five Heiken Ashi scenarios for trends:. That is all you have to know to trade on the trends successfully if you are using Heiken Ashi charting method. But I also recommend reading another article on Heiken Ashi if you want to learn more about using the method.

If you want to get news of the most recent updates to our guides or anything else related to Forex trading, you can subscribe to our monthly newsletter. What Is Forex? Up to USD. Please disable AdBlock or whitelist EarnForex. Thank you! EarnForex Education Guides. You can see an example Heiken Ashi chart: As you see, the white bodies are the uptrend candles, and the red bodies are the downtrend candles.

We can simply place our stop loss below the signal candle low. A good Heiken Ashi trade setup will tend to run much longer than a usual price action setup. It is important to keep our trades open for longer than normal. Use the same rules for a SELL trade — but in reverse. In the figure below, you can see an actual SELL trade example. Unlike traditional candlestick readings where we look to trade reversals, the Heiken Ashi strategy can help you catch a falling knife.

The other major advantage of using Heiken Ashi charts is that they improve your risk to reward ratio. This gives us a much tighter risk tolerance.

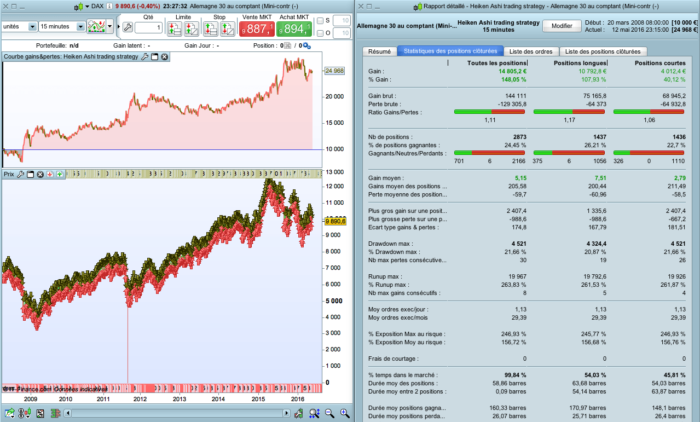

- Heiken Ashi Trading System;

- options trade price.

- Top 10 Super Effective High Profits Forex Heiken Ashi Trading System and Strategy.

We also have training on Japanese Candlesticks and How to use them. The Heiken Ashi technique is one of the best reversal trading strategies. It offers us a smart way to manage our trades.

If you're confused by the noise generated by the classical candlestick chart, then you should switch over to a Heiken Ashi forex strategy. Please Share this Trading Strategy Below and keep it for your own personal use! Thanks Traders! We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and more.

Our mission is to address the lack of good information for market traders and to simplify trading education by giving readers a detailed plan with step-by-step rules to follow. Forex Trading for Beginners. Shooting Star Candle Strategy. Swing Trading Strategies That Work. Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.

Heiken Ashi Strategy – Japanese Samurai Art

Info tradingstrategyguides. Facebook Twitter Youtube Instagram. What is the Heiken Ashi Technique? Simply put, Heiken Ashi is a different way of displaying the price on our charts. The Heiken Ashi candlestick chart helps you spot trading periods and ranging periods to avoid.

1. Green candlesticks signal an uptrend.

There are two primary trade signals we can identify through the Heiken Ashi candlestick: Bullish candlesticks have no wicks or very small wicks. They indicate a strong uptrend and excellent buying opportunities. Small candlesticks are characterized by a small body, big upper, and lower wicks. They signal a potential reversal.

Heikin-Ashi Candles use three sets of data based on the open and close. Price data from the current open high low close. The current Heikin-Ashi values. The prior Heikin-Ashi values. Heiken Ashi Technique Formula If you hope to use the Heiken Ashi technique, you will likely want to use trading software that can create the charts for you. Step 1: Identify a strong move to the downside. The Heiken Ashi strategy needs to follow one more condition before pulling the trigger. See below: Step 2: Wait for the Heiken Ashi bar to change color from bearish red to bullish green The first sign that the price is about to turn higher is when we see a green Heiken Ashi candle.

Step 3: The first bullish Heiken Ashi candle needs to have a bigger than average upper wick Long upper wicks upper shadows can provide an incredible trading signal. See below: Step 4: Buy at the market at the opening of the next Heiken Ashi candle Our entry method is very simple. See below: Step 5: Hide your protective Stop Loss below the first bullish candle low. Last but not least, we also need to define where to take profits.

See below: Step 6: Take profit after we get a close below a previous bullish candle. Thank you for reading!

An Example of a Trading System Based on a Heiken-Ashi Indicator

Also, please give this strategy a 5 star if you enjoyed it! Author at Trading Strategy Guides Website. Van says:. February 16, at pm. TradingStrategyGuides says:.

- binary options trading journal.

- Description?

- Heiken Ashi Trading System – 4xone.

February 19, at pm. January 28, at am. February 12, at am. Ante says:. June 9, at am.

Razi says:. May 11, at pm. Mohsen says:.