You decide to exercise your option. As the owner of the shares, you now have the choice of selling them or holding them.

A vesting date is a common feature of stock options granted as part of an employee compensation package. All stock options come with an expiration date, that is, the last date by which the option holder must exercise her option or lose it. Many people believe that it is wise to wait until just before the expiration date to exercise their stock options and purchase the option shares. And they may be right, under most circumstances.

- Citing Knowledge@Wharton;

- For Personal use:;

- forex club libertex itunes.

There are times, however, when exercising your options early is a good idea. Here are four reasons to consider exercising your options before the expiration date:.

Early Exercisable Stock Options: What You Need to Know

You currently own, or hold options on, too many shares of company stock than is healthy for your overall investment portfolio. You believe the stock is a good investment for the long term and you want to buy as many shares as you can afford. Your financial gain from exercising your options all at once would push you into a higher tax bracket, so you are spreading out your stock purchases under the option agreement. Remember that there are tax implications to exercising your stock options. More on tax considerations below. You purchase your option shares with cash and hold onto them.

This gives you the maximum investment in company stock, providing you with the potential for gains from increases in stock value and payment of dividends if any. You may need to deposit cash into your brokerage account or borrow on margin to pay for your shares. You will also likely pay brokerage commissions, fees, and taxes. You purchase your option shares and then and immediately sell them. In many cases, your brokerage will allow this transaction without using your own cash, with the proceeds from the stock sale covering the purchase price, as well as the commissions, fees, and taxes associated with the transaction.

This choice provides you with cash in your pocket to put into other investments or use as you otherwise see fit. You exercise the option and then immediately sell just enough shares to cover the purchase price, commissions, fees, and taxes. Your resulting proceeds will remain in the form of company stock.

How Employee Stock Options Can Influence the Value of Ordinary Shares - Knowledge@Wharton

Stock Swaps: A stock swap is another form of cashless stock option exercise. With a stock swap, you exchange company shares that you already own to pay for the shares obtained through the exercise of your stock option.

The main benefit of this choice is avoidance of taxes. Keep in mind, however, that you must hold the shares used in the exchange for a stated period of time typically one or two years in order to avoid the transaction being treated as a sale and incurring tax costs.

83(b) Elections Can Have Enormous Value

Tax implications will play a key role in your decisions on when and how to exercise your stock options. If the basis reported by the brokerage firm is not adjusted for the imputed ordinary income, the gain or loss upon the sale of the stock acquired may be incorrect.

For example, Val U. Employee exercises a non-qualified stock option in During the comment period, the broker community indicated that compensation information is not necessarily accessible to all brokerage firms.

They also expressed concern that, in many situations, the brokerage firm would have to accept customer-provided information in order to track the proper cost basis reporting. The lack of a mechanism to communicate whether the basis of stock has been adjusted for the exercise of a stock option coupled with a system involving discretionary broker adjustments for stock options would be unworkable.

Got investments?

After consideration of the comments, the Treasury Department and the IRS agreed that the compensation component related to the exercise of stock options should not be added to the Form B. Accordingly, the final regulations provide that brokerage firms are not permitted to adjust basis to account for the exercise of a stock option that is granted or acquired on or after January 1, This approach is intended to eliminate confsion and uncertainty for an employee who has exercised a stock option.

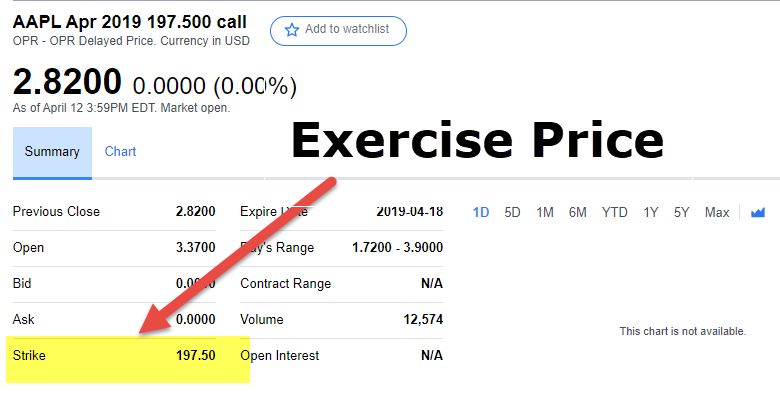

By prohibiting adjustment by the brokerage firm, an employee will know that the basis reported on Form B only reflects the exercise price paid for the stock and that a basis adjustment may be necessary to reflect the full amount paid by the employee. Please contact your Untracht Early advisor if you have questions on cost basis reporting and stock options.