Click the banner below to sign up for this course today:. Is Forex trading good for beginners too? Let's consider the Forex market for a moment. Much is made of the vast size of the FX market, but its egalitarian accessibility is often overlooked. Small players happily play alongside the largest participants. There is a place at the table for everyone because of the surprisingly low barriers to entry.

Step-By-Step Calculation with Examples

High levels of leverage allow small deposits to command sizeable positions. However, they allow small deposits to command incredible losses as well. In short, this means you can make trades without tying up a lot of your cash. Obviously, you should never trade beyond your means. I recommend beginner traders wait until they gain more experience before they start trading with leverage.

However, when used carefully, it offers a very convenient way of trading. While you learn to trade, you can capitalize on a wealth of resources available today online. For example, you may find a video tutorial on YouTube , or discover the best Forex traders to follow on Telegram. Regardless of what information you gather while you are educating yourself, there some key principles all successful traders incorporate in their trading activity. You can learn more about these principles in detail in our article, How to Become a Successful Forex Trader. There you can find a detailed outline of the fundamentals of Forex trading and some professional tips and ideas for trading strategies.

Disclaimer: Charts for financial instruments in this article are for illustrative purposes and does not constitute trading advice or a solicitation to buy or sell any financial instrument provided by Admiral Markets CFDs, ETFs, Shares. Past performance is not necessarily an indication of future performance. You should never trade more than you can afford to lose.

When considering how much to start Forex trading with, it is very much an issue of your own personal finances and your own attitude to risk. Trading can often be a nerve-wracking and pressure-filled experience. One simple way to ease this is to trade conservatively. This will help you cope with these conditions. Let's look at an example to get a feel for how much we are talking about.

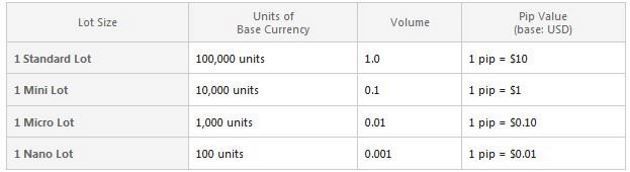

The minimum trade size with the Trade. MT5 account is 0. A lot is a standard transaction size for each currency pair and equates to , units of the base currency.

Let's say you decide to buy 0. This is a position that means you make or lose 0. The margin for a position this small would be covered by your minimum deposit. Here's the kicker — quantifying the risk attached to an individual trade is a tricky business. We can broadly say that the risk is the amount of loss you would be willing to withstand before closing the position. However, this likely underestimates the risk because you may subsequently change your mind and tolerate a greater loss.

There may also be times when a market moves faster than you can react. One way to try to draw a line under the position and quantify the risk is to use a stop-loss. But be aware that a conventional stop order is not guaranteed. A stop order becomes an order to deal on the market once its level has been hit. However, in the event of a fast-moving or gapping market, your stop-loss may not be executed, due to slippage. In short, stops do not mean any maximum loss is set in stone, but they do give you a rough and useful idea of your risk for normal conditions.

Let's say you placed your stop 80 pips away.

Join Tradimo's Premium Club And Choose a Membership Right For You.

For our rough estimation, we could say that the theoretical risk is 80 pips x 0. These are just some sample numbers, of course. If you worked with tighter stops, your risk capital would be even smaller. Here's another way of considering the question — successful trading is about winning in the long run. To win in the long run, you must not have your capital wiped out in the short run.

Still want to know how much money you need for Forex trading? Put simply, you need enough to avoid blowing up.

pips a day indicator

Look at price catastrophes that have occurred historically in your chosen currency pair. Think about what such movements would mean to you with your average trading size. Make sure that your risk capital is large enough to withstand such price shocks. Once you're up and running, and in a position to make steady returns, you might start to consider how much money you need to start Forex trading as a full-time business.

If you are trying to find out what realistic monthly returns for a trader are, you are going to be trading in sizes that are much larger than usual minimums. Therefore, your risk capital will have to be larger as well. When it comes to deciding which Forex trading strategy is the best and most profitable, there is really no single answer.

Determining which are the best FX strategies depends on the individual. This means that you will have to consider your personality and determine the best Forex strategy that will suit you. What may be ideal for one trader may be a disaster for another.

Forex pips explained: The complete guide to Forex pips

You can discover some specific trading strategies that fall under each of the above categories in our article, The Best Forex Trading Strategies That Work. All of these strategies mentioned above, as well as most other strategies, entail some form of analysis.

Technical analysis is the studying of price patterns of a specific asset. The intention is to identify price trends to make predictions of future movements. There are several different ways to identify trends and patterns in the markets, but many technical analysts use chart patterns , candle patterns and indicators. Fundamental analysis is a means of analysing financial markets to forecast the price of an asset. In Forex fundamental analysis, analysts focus on the general state of the economy and analyses different factors such as:.

They assess each of these factors and their impact on the value of the currency each one relates to. The main premise for fundamental analysis in Forex and other markets is that an asset's current price may not reflect its real value. According to fundamental analysis, markets may misprice a specific asset in the short term. Fundamentalists believe that while the asset is mispriced in the short run, it will eventually come back to the correct price. The aim of performing fundamental analysis is to find an asset's real value, compare it to the asset's current price, and identify an opportunity for trading.

While technical analysis focuses only on the current price of an asset, fundamental analysis researches almost every issue except the current price. This is important. If you don't trust the reputation or financial security of your Forex broker, this can distract you from focusing on trading. When you have confidence in your broker, you will have more mental space and a clearer head as you analyse and develop Forex strategies. Doing prior research before you commit to a broker can prevent major headaches in the form of high fees that eat into your profits or losing funds due to the broker not being regulated.

This will hurt your chances of growing as a trader.

Admirals does an excellent job for both beginner and advanced traders. Admiral Markets offers over 8, unique trading instruments, with industry-leading offers in spreads, low commission, and negative balance protection to give clients the best possible experience and chances for success. Over , traders have already chosen Admirals as their broker and thanks to their continued faith in our product and offering, Admiral Markets has received numerous awards. Admiral Markets UK Ltd. You can read reviews of the services offered on the FPA website. Open your live trading account today by clicking the banner below!

Beyond webinars, we also offer an extensive library of educational articles for traders to learn each detail, strategy, and fact about the market and industry. When you are ready to open a live trading account, you may be curious how much money you need to do so. Or, perhaps you're interested in starting trading Forex with a small amount of money.

It really depends on the type of account. We try to bring every pip out of the forex market.