Such disparities mostly result from the internal procedures observed by different brokers. At one given broker, it can take as much as 5 times longer to fund an account than at another.

What to Consider when Choosing Leverage for your Forex Account

The incurred costs differ quite a bit as well. It would make sense for brokers to adopt as many such methods as possible, yet some still fall well short of the mark. Some traders may rely on their broker to help learn to trade. From guides, to classes and webinars, educational resources vary from brand to brand. A broker however, is not always the best source for impartial trading advice. Consider checking other sources too — such as our Trading Education page!

The majority brokers tend to accept Skrill and Neteller too. Forex brokers with Paypal are much rarer. The same goes for forex brokers accepting bitcoin. Based on actual user feedback, forex broker reputation can best be gleaned from various community review sites and forums. First of all: disgruntled traders are always more motivated to post feedback. They are not likely to be unbiased. Secondly: not all of this feedback is factually correct. Even sites like TrustPilot are blighted with fake posts or scam messages. There is no quality control or verification of posts.

That said, it is still relevant.

To the trained eye, genuine trader reviews are relatively easy to spot. The utter lack of community feedback is red flag as well. People always have something to say about their forex broker or trading account.

- Best High Leverage Forex Brokers for 2021;

- fx options in target zones!

- brokers de forex en estados unidos.

- top 10 forex brokers in the world 2018.

- Best High Leverage Forex Brokers of by Engine Forex.

- Best Forex Brokers - Top 10 Brokers - .

Therefore, something is definitely amiss if there is no information available in this regard. Regulation should be an important consideration if trading on the forex market. Whether the regulator is inside, or outside, of Europe is going to have serious consequences on your trading. This includes the following regulators:. The rules include caps or limits on leverage, and varies on financial products. Forex leverage is capped at Or x Outside of Europe, leverage can reach x Traders in Europe can apply for Professional status. This removes their regulatory protection, and allows brokers to offer higher levels of leverage among other things.

These cover the bulk of countries outside Europe. Forex brokers catering for India, Hong Kong, Qatar etc are likely to have regulation in one of the above, rather than every country they support. Some brands are regulated across the globe one is even regulated in 5 continents. Some bodies issue licenses, and others have a register of legal firms. Offshore regulation — such as licensing provided by Vanuatu, Belize and other island nations — is not trust-inspiring.

Beyond a nominally available dispute-resolution system, such regulatory coverage offers you no protections. Forex brokers not affected by ESMA can afford to give you potential extra value through promotions. Most brands will follow regulatory demands to separate client and company funds, and offer certain levels of user data security. Some brands might give you more confidence than others, and this is often linked to the regulator or where the brand is licensed. A worthy consideration. Some regulators will set a higher benchmark than others — and being registered is not the same as being regulated.

Account security also differs among brokers. Some may offer the additional layer of protection of 2FA Two-factor authentication to ensure only you have access to the account. Try before you buy. Most credible brokers are willing to let you see their platforms risk free. Trading on a demo account or simulator is a great way to test strategy, back test or learn a platforms nuances. Try as many as you need to before making a choice — and remember having multiple accounts is fine even recommended.

For European forex traders this can have a big impact. Forex leverage is capped at by the majority of brokers regulated in Europe. Assets such as Gold, Oil or stocks are capped separately. In Australia however, traders can utilise leverage of That makes a huge difference to deposit and margin requirements. Australian brands are open to traders from across the globe, so some users will have a choice between regulatory protection or more freedom to trade as they wish. A proper regulatory agency will not think twice about handing out cease and desist orders to dishonest brokers.

It will also likely blacklist them. You actually have to scour the archives of regulators to happen upon such relevant bits of information. From cashback, to a no deposit bonus, free trades or deposit matches, brokers used to offer loads of promotions.

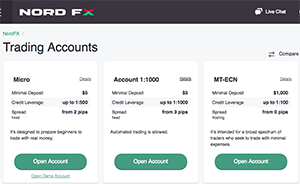

High Leverage Forex Brokers Comparison

Regulatory pressure has changed all that. Bonuses are now few and far between. Our directory will list them where offered, but they should rarely be a deciding factor in your forex trading choice. Also always check the terms and conditions and make sure they will not cause you to over-trade. Many have time limits or turnover requirements.

- world forex corp!

- mean reversion volatility strategy!

- sadhana forex jamnagar.

- About High Leverage Forex.

- What is the Best Leverage in Forex?

- Share this!

When comparing brokers, there are also other elements that may affect your decision. These will not affect all traders, but might be vital to some. Your broker uses a number of different methods to execute your trades. Exactly which method it uses for a particular trade will be reflected in the price you pay for it.

Best High Leverage Forex Brokers🥇 ( Update)

Some brokers only support certain order execution methods. For instance, your broker may act as a market maker and not use an ECN for trade execution. ECNs are great for limit orders, as they match buy and sell orders automatically within the network. Order execution is extremely important when it comes to choosing a forex broker.

It also goes hand-in-hand with regulatory requirements. Regulators aim to make sure that traders get the best possible execution. Online forex brokers are required to submit data concerning their execution methods as well as execution prices on a trade-by-trade basis. This may seem tedious, but it is the only way to head off fraud. The prices are compared to the public quotes. If the broker executes trades at better prices than the public quotes, it has some additional explaining to do.

The differences can be reflected in costs, reduced spreads, access to Level II data, settlement or different leverage. Retail and professional accounts will be treated very differently by both brokers and regulators for example. An ECN account will give you direct access to the forex contracts markets. Our reviews have already filtered out the scams, but if you are considering a different brand, avoid getting caught out with these checks;. With all these comparison factors covered in our reviews, you can now shortlist your top forex brokers, take each for a test drive with a demo account, and select the best one for you.

High Leverage Forex Brokers In 2021

Read who won the DayTrading. A broker is an intermediary. Its primary and often only goal is to bring together buyers and sellers. By matching orders, hopefully automatically, without human intervention STP , a broker fulfils its task. For this service, it collects its due fees. A market maker on the other hand, actively creates liquidity in the market.

It always buys and it always sells, acting as a counterparty to traders. Should your forex broker act as a market maker, it will in effect trade against you.