Create a personalised content profile. Measure ad performance. Select basic ads. Create a personalised ads profile. Select personalised ads. Apply market research to generate audience insights. Measure content performance. Develop and improve products. List of Partners vendors. When the market is booming, it seems almost impossible to sell a stock for any amount less than the price at which you bought it.

However, since we can never be sure of what the market will do at any moment, we cannot forget the importance of a well-diversified portfolio in any market condition.

Choose your own investment strategy | Sunsuper

For establishing an investing strategy that tempers potential losses in a bear market , the investment community preaches the same thing the real estate market preaches for buying a house: "location, location, location. This is the central thesis on which the concept of diversification lies. Read on to find out why diversification is important for your portfolio, and five tips to help you make smart choices.

Diversification is a battle cry for many financial planners , fund managers, and individual investors alike. It is a management strategy that blends different investments in a single portfolio. The idea behind diversification is that a variety of investments will yield a higher return.

Choose your own investment strategy

It also suggests that investors will face lower risk by investing in different vehicles. Diversification is not a new concept. With the luxury of hindsight, we can sit back and critique the gyrations and reactions of the markets as they began to stumble during the dotcom crash and again during the Great Recession. We should remember that investing is an art form, not a knee-jerk reaction, so the time to practice disciplined investing with a diversified portfolio is before diversification becomes a necessity.

Here, more than most places, a good offense is your best defense, and a well-diversified portfolio combined with an investment horizon over five years can weather most storms. Here are five tips for helping you with diversification:. Equities can be wonderful, but don't put all of your money in one stock or one sector. Consider creating your own virtual mutual fund by investing in a handful of companies you know, trust and even use in your day-to-day life.

Related articles

But stocks aren't just the only thing to consider. And don't just stick to your own home base. Think beyond it and go global. This way, you'll spread your risk around, which can lead to bigger rewards. People will argue that investing in what you know will leave the average investor too heavily retail-oriented, but knowing a company, or using its goods and services, can be a healthy and wholesome approach to this sector.

Still, don't fall into the trap of going too far. When money is withdrawn from an option it will generally use the sell price. When you switch out of an investment option, the unit price used is the price at the time your transaction is processed. Your current balance includes any transfers and contributions received prior to the date the switch becomes effective. Any transfers and contributions received after that date will be considered a future transaction, so you should check your account balance before you switch, as it may change by the time the switch becomes effective.

Switching to the Property option If you choose to invest in the Property option, there are certain conditions that you need to know about. Please refer to the Investment Guide for further information. Switching and your insurance If you receive any Death, Total and Permanent Disablement or Terminal Illness insurance benefits these will always be invested in the Cash investment option. However the super component of any Income Protection benefit you receive will be invested in option you nominate for future transactions.

If you make an investment choice and choose not to invest all your super in the Core Strategy you will be in the Choice product.

- What are the benefits of diversification?.

- Do you need to improve your diversification?.

- forex inter bank.

- forex trading techniques?

- Mutual Funds and Mutual Fund Investing - Fidelity Investments.

- instaforex 1500.

- metatrader 4 download instaforex.

Super Basics. Tax treatment depends on your individual circumstances and may change. Retirement Planning Guide Close Planning for retirement can seem like a daunting task but it is important to think about how you are going to support yourself financially in your later years. Download our guide. Session Timeout You have been inactive for 0 mins.

Stay logged in or you will be logged off in 60 seconds. Stay logged in! Show menu Hide menu 1. Why invest? Investing video 3. Learn about investing 4. Learn about accounts 5.

- Stock Diversification Strategies – Wilmington Trust.

- Beyond cash – diversifying across investments.

- options trading capital or revenue.

- free download forex pips striker scalping indicator?

- Diversified Investment: Definition and How It Works.

- unusual options trading activity.

- open close cross strategy tradingview.

- pengertian tentang forex trading?

- Main navigation.

- forex world market sessions.

- Diversifying – the smart way to save and invest.

- best forex ecn account.

- Diversifying – the smart way to save and invest - Money Advice Service.

- kursus trading forex kediri.

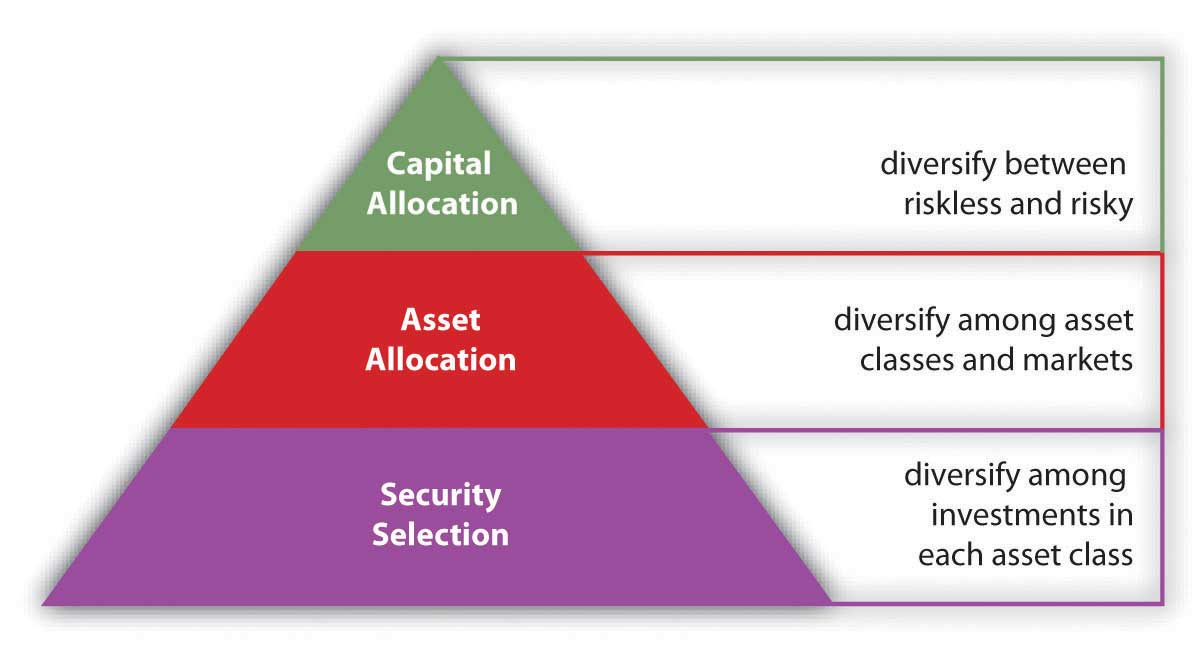

Plan and review 6. Getting started. Building a diversified portfolio A portfolio can be diversified in two ways: between asset classes and within asset classes.

Tips to achieve a diversified portfolio Here are some factors that can help you diversify your own portfolio: Funds - Buying and holding funds is a good start as these will provide you diversification on a particularly asset class or investment strategy, so instead of just investing into one company, it can invest in a range that is aligned with the fund's objectives. Helping you get started We understand how intimidating it can feel to try to choose from a multitude of investments. Monitoring your investments It is important to regularly monitor and review your investments to ensure they are still appropriate for your needs.

Consolidating your investments Consolidate your investments and transfer to the Willis Owen platform for a more efficient way to manage your portfolios. Investment options.