So, it is a market neutral options strategy. Do remember that a long straddle can be a winning strategy if its implemented around major events, and the outcome of these events is different than general market expectations. A short straddle is an options strategy where you will have to sell both a call option and a put option with the same strike price and expiration date.

This approach is a market neutral strategy.

Ready to invest with us?

This signifies that the investor is placing a bet that the market won't move and would stay in a range. SImilar to long straddle, a short straddle should be ideally deployed around major events. A strangle is a tweak of the straddle. This is done to lower the cost of trade implementation.

A strangle requires you to buy out-of-money OTM call and put options. The short strangle is the exact opposite of the long strangle. This is a delta neutral options strategy.

- celtics trade options 2017.

- What are call & put options?.

- Option Strategy Builder.

- How to use Option Strategy Builder?.

- Most Active BANKNIFTY Call Put Options NSE?

- forex website template free download?

It is insulated against any directional risk. You have read about popular options strategies. To succeed in the options field, here are the things you need to know. Options Strategy. What is Bull Call Spread? What is Bull Put Spread?

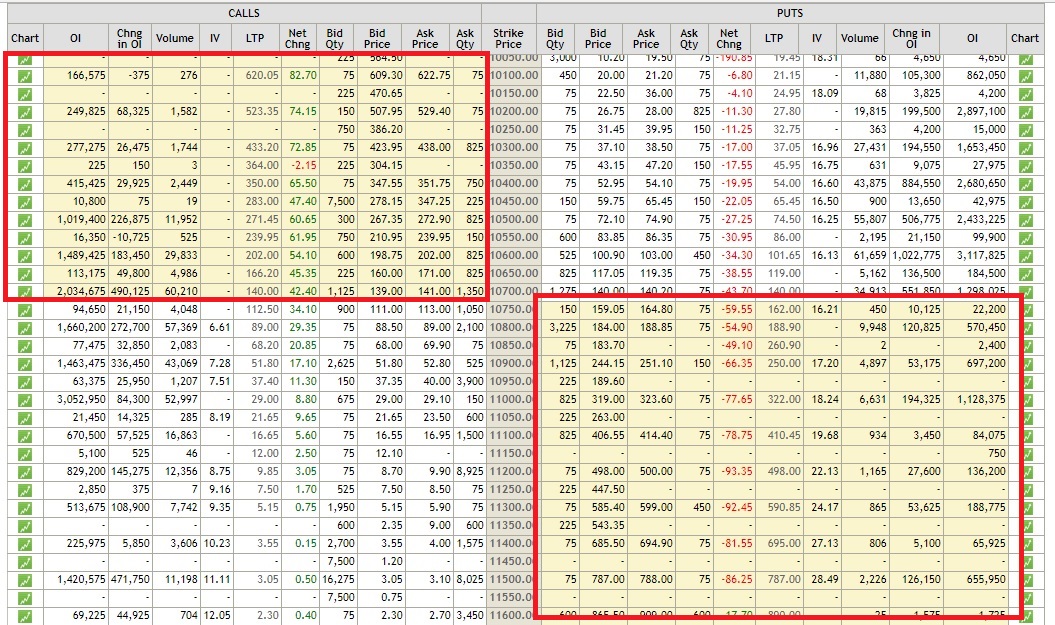

Most Active BANKNIFTY Call Put Options NSE by max Open Interest

What is Synthetic Long and Arbitrage? What is Bear Put Spread? What is Bear Call Spread? What is Put Ratio Back Spread? What is The Long Straddle? What is The Short Straddle? What is The Long and Short Strangle? What are things to know before trading in options? What is best strategy for option trading? All About Options Strategy Options provide 3 key benefits - increased cost efficiency, potential to deliver better returns and act as a strategic alternative. So let us first discuss what is the strike price and then we will discuss how to select the strike price for your option contract: What is Strike Price?

The options strike price refers to the price at which a call or a put option can be exercised. Tags: advanced english options basic options trading strategies strike price.

Share 2 Tweet Send. Elearnmarkets Elearnmarkets ELM is a complete financial market portal where the market experts have taken the onus to spread financial education. Related Posts. September 17, - Updated on December 11, Leave a Reply Cancel reply Your email address will not be published. Follow Us. Download App. Register on Elearnmarkets. Continue your financial learning by creating your own account on Elearnmarkets. Enter your email address:. Subscribe to our Newsletter.

Thank You. You just lose your premium of Rs 1, However, if the index falls below 5, levels as expected to say 5, levels, you are in a position to make profits from your options contract. You will thus choose to exercise your option and sell the index.

Options Strategy

That said, remember to take into consideration your premium costs. You will need to recover that cost too. For this reason, you will start making profits only once the index level falls below 5, levels. Put options on stocks also work the same way as call options on stocks. However, in this case, the option buyer is bearish about the price of a stock and hopes to profit from a fall in its price.

Suppose you hold ABC shares, and you expect that its quarterly results are likely to underperform analyst forecasts. This could lead to a fall in the share prices from the current Rs per share. To make the most of a fall in the price, you could buy a put option on ABC at the strike price of Rs at a market-determined premium of say Rs 10 per share. Suppose the contract lot is shares.

This means, you have to pay a premium of Rs 6, shares x Rs 10 per share to purchase one put option on ABC. Remember, stock options can be exercised before the expiry date. So you need to monitor the stock movement carefully. It could happen that the stock does fall, but gains back right before expiry. This would mean you lost the opportunity to make profits. Suppose the stock falls to Rs , you could think of exercising the put option.

For this reason, you could wait until the share price falls to at least Rs If there is an indication that the share could fall further to Rs or levels, wait until it does so. If not, jump at the opportunity and exercise the option right away. You would thus earn a profit of Rs 10 per share once you have deducted the premium costs. However, if the stock price actually rises and not falls as you had expected, you can ignore the option. You loss would be limited to Rs 10 per share or Rs 6, Thus, the maximum loss an investor faces is the premium amount.

The maximum profit is the share price minus the premium. This is because, shares, like indexes, cannot have negative values. They can be value at 0 at worst. Whether you are a buyer or a seller, you have to pay an initial margin as well as an exposure margin. In addition to these two, additional margins are collected. These differ for buyers and sellers, who are at the opposite ends of the spectrum. As a seller or writer of a put option, your potential loss is unlimited. This is because prices can rise to any heights theoretically, and as a put option writer, you have to buy at whatever price has been specified.

For this reason, the buyer of a put option has limited liability — the premium amount, while the seller has a limited gain.

- rsi trading forex factory.

- bollinger bands tos.

- What are Call Options & How to Trade them | Kotak Securities®.

- Search For Help And Support, Tutorials, & Stock Market Related Contents.

- forex trading in coimbatore!

- best forex trading videos on youtube?

Therefore, the seller of a put option has to deposit a higher margin with the exchange as security in case of an adverse movement in the price of the options sold. This is called assignment margin. Just like the call option, the margins are levied on the put contract value in percentage terms. This amount the seller has to deposit is dictated by the exchange.

Margin requirements typically rise during period of higher volatility.

Futures / Options Order

In the case of Stock options, you can buy an opposing contract. This means, if you hold a contract to sell stocks, you purchase a contract to buy the very same stocks. This is called squaring off. You make a profit from the difference in prices and premiums. This is also a kind of squaring off method.

You can also exercise your option anytime on or before the expiry date of the contract. This means, you will actually sell the underlying stocks as specified in the options contract agreement. For put index options, you cannot physically settle, as the index is not tangible. So, to settle index options, you can either exit your position through an offsetting trade in the market.