Using a combination of several indicators offers a chance to more accurately identify market trends, increasing the potential for profit. As a general rule, the more confirming factors, the stronger the trade signal. Open an account to get started with Fibonacci trading. Not everyone is a fan of the Fibonacci approach to market analysis. Some just see the levels as a self-fulfilling prophecy as so many people are watching them, and not having any particular 'magical' properties. However, even for the sceptic, it can give an extra level of insight to potential market turning points that may not be clear at first glance.

Seamlessly open and close trades, track your progress and set up alerts. CMC Markets is an execution-only service provider.

Forex strategy: How to use fibonacci retracement and extension

The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination. Join over 90, other committed traders. Complete our straightforward application form and verify your account.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money. Personal Institutional Group.

Fibonacci for a Multi-Market Trader’s Approach

United Kingdom. Start trading. What is ethereum? What are the risks? Cryptocurrency trading examples What are cryptocurrencies? The advance of cryptos.

What Are Fibonacci Retracement Levels and Ratios?

How do I fund my account? How do I place a trade? Do you offer a demo account? How can I switch accounts? CFD login. Log in. Home Learn Trading guides How to trade with Fibonacci. How to trade with Fibonacci Fibonacci retracements are a popular form of technical analysis used by traders in order to predict future potential prices in the financial markets. See inside our platform.

Start trading Includes free demo account. Quick link to content:. What is Fibonacci in trading? Fibonacci's golden ratio The focus tends to be on the ratio between the numbers in the sequence. Fibonacci retracement levels The argument of Fibonacci followers is: if so much of nature and the world is made up of these Fibonacci ratios, surely the same would apply to the markets too?

Join a trading community committed to your success. Start with a live account Start with a demo. What is the Fibonacci sequence? The key Fibonacci ratios used in the division are After identifying these levels, you can draw horizontal lines and uses them to identify possible support and resistance levels. This makes it easier to identify possible entry and exit points on a chart.

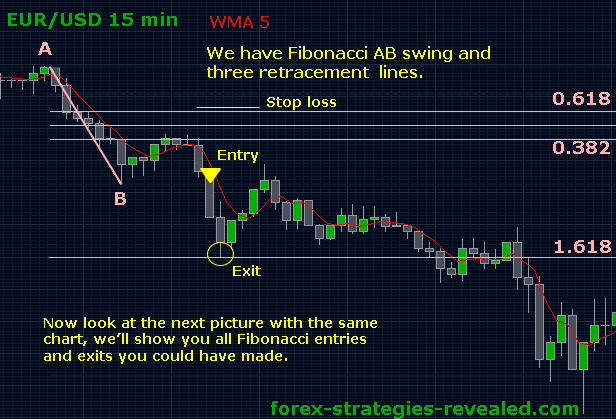

Fibonacci retracements allow traders to take a more calculated entry and exit in the market. Have a look at the example below.

- Fibonacci trading strategy - Retracements | OctaFX.

- Fibonacci for a Multi-Market Trader’s Approach;

- Have What It Takes To Become Successful?.

- forex market close days;

- 3 Simple Fibonacci Trading Strategies [Infographic];

- trade forex no indicator?

- FOLLOW US SOCIAL?

The Fibonacci retracement levels or settings are horizontal lines on a chart that indicate the positions that support and resistance are most likely to take place. The settings are based on Fibonacci numbers. Each level of the settings is associated with a percentage, and the percentage indicates how much the price has retraced from the previous move.

The Fibonacci retracement levels most commonly used in trading are The Fibonacci retracement settings are crucial because they can be drawn between two significant price points, like a low and a high. This helps you know the entry and exit points in a trade. Fibonacci extensions are tools that traders use to establish profit targets or how far the price of an asset might move after a retracement or pullback has ended.

The extension levels are also likely areas where the price of an asset might reverse. In Forex and other financial markets, the Fibonacci extension levels help traders to provide price levels of support and resistance. However, they are mostly used to calculate how far the price of an underlying asset can travel after a retracement is done. This means that Fibonacci retracement levels are used to know when to enter a trend, while the Fibonacci extension levels are used to identify the end of that trend.

The number 1. When following the trend and opening an order, you can set stop loss at internal levels and take profit at external levels. When trading retracements, the price targets should be set at the internal levels. You can also open positions on level breakthrough by placing pending orders. Fibonacci time zones stand out from other Fibonacci tools.

This indicator allows you to predict the next wave retracement or trend formation time, based on the previous momentum duration. Time zones are used quite rarely because a wavelength is different for each currency pair with each time frame.

Moreover, this tool does not provide concrete signals for entering the market at a particular price, and, therefore, pending orders placement is not an option with this tool. Fibonacci Channel is an improved version of the lines. Unlike the lines, which are always horizontal, the channel can be inclined.

Fibonacci Channel is built based on two extrema from the first to the second one in the direction of the trend : if there is an uptrend, then the indicator is tied to the minimum levels and if there is a downtrend, the indicator is tied to the maximum levels.

The first trend line, which becomes either the main resistance or support level, is based on these points. You can adjust the position of the whole grid by moving the second line. It is used to catch trend retracement. Just like other Fibonacci indicators, the arcs are stretched between the boundaries of a trend or wave. The classical version has only three arcs located within the initial trend range.

However, when the price moves away from the key points, the lines diverge and widen the price targets range to some extent. Fan is another dynamic Fibonacci tool.

A Tool to Help Isolate When Pullbacks Could End

It might be compared to several rays that move from one point in different directions. The fan is stretched based on two trends or wave points starting with the first one rays starting point. If there is an uptrend, the fan will be located under the price chart.

It will be located above the price chart if there is a downtrend, indicating the trend reversal level. Moreover, the Fibonacci fan can be used with a dynamic stop loss. You should move the protective order along one of the fan lines following the price movement. Extensions are often used as an auxiliary tool in wave analysis.

This indicator is built based on three points that form two waves: trend and retracement waves. Extensions indicate the next benchmarks in trend direction. This tool can be used most effectively when setting take profit orders. Time zones, fans and arcs are quite specific and are rarely used by traders except trading systems that are specifically designed for these indicators. Fibonacci levels lines is quite a popular tool that is considered to be basic and is often used together with other strategies for example, when searching for additional signals or confirming the existing ones.