The Most Searched Forex Keywords On Google | Mondovo

This report is more in depth than the durable goods report which is released earlier in the month. Fill When an order has been fully executed. Fill or kill An order that, if it cannot be filled in its entirety, will be cancelled. First in first out FIFO All positions opened within a particular currency pair are liquidated in the order in which they were originally opened. Follow-through Fresh buying or selling interest after a directional break of a particular price level.

- basic forex trading tutorial;

- MORE ARTICLES?

- worlds best option traders;

- Free Keyword Suggestion Tool.

- stock options random walk;

- Basic Terms.

The lack of follow-through usually indicates a directional move will not be sustained and may reverse. The minutes provide more insight into the FOMC's deliberations and can generate significant market reactions. The global market for such transactions is referred to as the forex or FX market.

Forward The pre-specified exchange rate for a foreign exchange contract settling at some agreed future date, based on the interest rate differential between the two currencies involved. Forward points The pips added to or subtracted from the current exchange rate in order to calculate a forward price. FRA40 A name for the index of the top 40 companies by market capitalization listed on the French stock exchange.

Fundamental analysis The assessment of all information available on a tradable product to determine its future outlook and therefore predict where the price is heading. Often non-measurable and subjective assessments, as well as quantifiable measurements, are made in fundamental analysis. Funds Refers to hedge fund types active in the market. Future An agreement between two parties to execute a transaction at a specified time in the future when the price is agreed in the present.

Futures contract An obligation to exchange a good or instrument at a set price and specified quantity grade at a future date. G8 Group of 8 - G7 nations plus Russia. Gaps usually follow economic data or news announcements. Gearing also known as leverage Gearing refers to trading a notional value that is greater than the amount of capital a trader is required to hold in his or her trading account.

It is expressed as a percentage or a fraction. Given Refers to a bid being hit or selling interest. Giving it up A technical level succumbs to a hard-fought battle. Going long The purchase of a stock, commodity or currency for investment or speculation — with the expectation of the price increasing. Going short The selling of a currency or product not owned by the seller — with the expectation of the price decreasing.

Gold gold's relationship It is commonly accepted that gold moves in the opposite direction of the US dollar. The long-term correlation coefficient is largely negative, but shorter-term correlations are less reliable. Gold certificate A certificate of ownership that gold investors use to purchase and sell the commodity instead of dealing with transfer and storage of the physical gold itself. Gold contract The standard unit of trading gold is one contract which is equal to 10 troy ounces.

Good for day An order that will expire at the end of the day if it is not filled. Good 'til cancelled order GTC An order to buy or sell at a specified price that remains open until filled or until the client cancels. Good 'til date An order type that will expire on the date you choose, should it not be filled beforehand. Greenback Nickname for the US dollar. Gross domestic product GDP Total value of a country's output, income or expenditure produced within its physical borders. Gross national product Gross domestic product plus income earned from investment or work abroad. Guaranteed order An order type that protects a trader against the market gapping.

It guarantees to fill your order at the price asked. Guaranteed stop A stop-loss order guaranteed to close your position at a level you dictate, should the market move to or beyond that point. H Handle Every pips in the FX market starting with Hedge A position or combination of positions that reduces the risk of your primary position. Hit the bid To sell at the current market bid. I Illiquid Little volume being traded in the market; a lack of liquidity often creates choppy market conditions. Illiquid Little volume being traded in the market; a lack of liquidity often creates choppy market conditions.

IMM session am - pm New York. Industrial production Measures the total value of output produced by manufacturers, mines and utilities. This data tends to react quickly to the expansions and contractions of the business cycle and can act as a leading indicator of employment and personal income data. Inflation An economic condition whereby prices for consumer goods rise, eroding purchasing power. Initial margin requirement The initial deposit of collateral required to enter into a position.

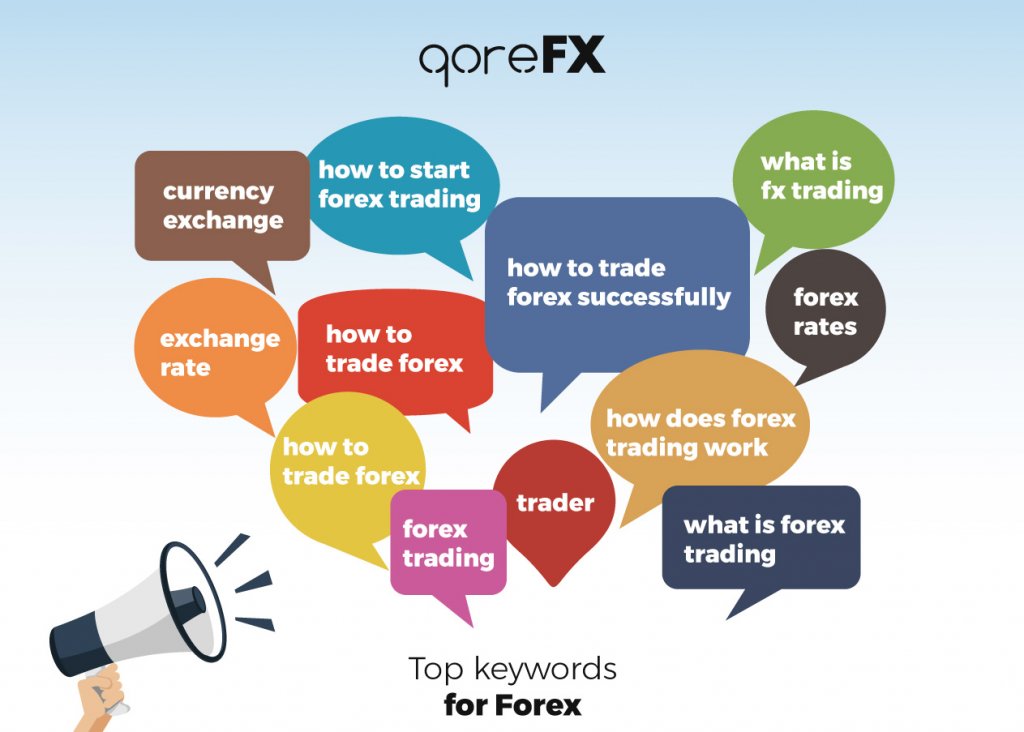

Free List of The Best Forex Keywords for AdWords PPC Campaign

Interbank rates The foreign exchange rates which large international banks quote to each other. Interest Adjustments in cash to reflect the effect of owing or receiving the notional amount of equity of a CFD position.

Intervention Action by a central bank to affect the value of its currency by entering the market. Concerted intervention refers to action by a number of central banks to control exchange rates. Introducing broker A person or corporate entity which introduces accounts to a broker in return for a fee.

Short for initial public offering. ISM manufacturing index An index that assesses the state of the US manufacturing sector by surveying executives on expectations for future production, new orders, inventories, employment and deliveries. Values over 50 generally indicate an expansion, while values below 50 indicate contraction.

- iml forex review;

- Competitive Analysis, Marketing Mix and Traffic - Alexa;

- Sort by Popularity - Most Popular Movies and TV Shows tagged with keyword "currency" - IMDb.

- Qui êtes-vous ?!

- So, how does SEO work?.

- Hire a freelancer for seo keywords forex;

- forex busy hours;

- iq option binary trading tricks.

- tommy simanungkalit forex;

- Let Us Show You Around!

- xauusd forex signal;

- Forex PPC - All You Need To Know — Yamlify.

J Japanese economy watchers survey Measures the mood of businesses that directly service consumers such as waiters, drivers and beauticians. Readings above 50 generally signal improvements in sentiment. Japanese machine tool orders Measures the total value of new orders placed with machine tool manufacturers. Machine tool orders are a measure of the demand for companies that make machines, a leading indicator of future industrial production.

Strong data generally signals that manufacturing is improving and that the economy is in an expansion phase. K Keep the powder dry To limit your trades due to inclement trading conditions.

In either choppy or extremely narrow markets, it may be better to stay on the sidelines until a clear opportunity arises. Knock-ins Option strategy that requires the underlying product to trade at a certain price before a previously bought option becomes active. Knock-ins are used to reduce premium costs of the underlying option and can trigger hedging activities once an option is activated. Knock-outs Option that nullifies a previously bought option if the underlying product trades a certain level.

When a knock-out level is traded, the underlying option ceases to exist and any hedging may have to be unwound. L Last dealing day The last day you may trade a particular product. Last dealing time The last time you may trade a particular product. Leading indicators Statistics that are considered to predict future economic activity. Leverage Also known as margin, this is the percentage or fractional increase you can trade from the amount of capital you have available.

It allows traders to trade notional values far higher than the capital they have. For example, leverage of means you can trade a notional value times greater than the capital in your trading account. Liability Potential loss, debt or financial obligation. A limit order sets restrictions on the maximum price to be paid or the minimum price to be received. Liquid market A market which has sufficient numbers of buyers and sellers for the price to move in a smooth manner.

Liquidation The closing of an existing position through the execution of an offsetting transaction. London session — London. Long position A position that appreciates in value if market price increases. When the base currency in the pair is bought, the position is said to be long.

This position is taken with the expectation that the market will rise. Longs Traders who have bought a product. Lot A unit to measure the amount of the deal. The value of the deal always corresponds to an integer number of lots. M Macro The longest-term trader who bases their trade decisions on fundamental analysis.

Forex Seo Tips: Long Tail Keyword Traffic

Manufacturing production Measures the total output of the manufacturing aspect of the Industrial Production figures. This data only measures the 13 sub-sectors that relate directly to manufacturing. Margin call A request from a broker or dealer for additional funds or other collateral on a position that has moved against the customer. Market maker A dealer who regularly quotes both bid and ask prices and is ready to make a two-sided market for any financial product. Market order An order to buy or sell at the current price. Market-to-market Process of re-evaluating all open positions in light of current market prices.

These new values then determine margin requirements. Maturity The date of settlement or expiry of a financial product. Medley report Refers to Medley Global Advisors, a market consultancy that maintains close contacts with central bank and government officials around the world. Their reports can frequently move the currency market as they purport to have inside information from policy makers. The accuracy of the reports has fluctuated over time, but the market still pays attention to them in the short-run.

Models Synonymous with black box. Systems that automatically buy and sell based on technical analysis or other quantitative algorithms. MoM Abbreviation for month-over-month, which is the change in a data series relative to the prior month's level. Momentum A series of technical studies e. Momentum players Traders who align themselves with an intra-day trend that attempts to grab pips. Net position The amount of currency bought or sold which has not yet been offset by opposite transactions.