Look out for: At least four bars moving in one compelling direction. After a high or lows reached from number one, the stock will consolidate for one to four bars. The high or low is then exceeded by am. Firstly, the pattern can be easily identified on the chart. Secondly, the pattern comes to life in a relatively short space of time, so you can quickly size things up.

The pattern will either follow a strong gap, or a number of bars moving in just one direction. In the late consolidation pattern the stock will carry on rising in the direction of the breakout into the market close. Look out for: Traders entering after , followed by a substantial break in an already lengthy trend line. Check the trend line started earlier the same day, or the day before. Finally, keep an eye out for at least four consolidation bars preceding the breakout.

There are some obvious advantages to utilising this trading pattern. The stock has the entire afternoon to run. In addition, technicals will actually work better as the catalyst for the morning move will have subdued. In few markets is there such fierce competition as the stock market. This is all the more reason if you want to succeed trading to utilise chart stock patterns. Many strategies using simple price action patterns are mistakenly thought to be too basic to yield significant profits. Yet price action strategies are often straightforward to employ and effective, making them ideal for both beginners and experienced traders.

Put simply, price action is how price is likely to respond at certain levels of resistance or support. Using price action patterns from pdfs and charts will help you identify both swings and trendlines. So, how do you start day trading with short-term price patterns? One obvious bonus to this system is it creates straightforward charts, free from complex indicators and distractions.

There is no clear up or down trend, the market is at a standoff. If you want big profits, avoid the dead zone completely. No indicator will help you makes thousands of pips here. This is where things start to get a little interesting.

Mengenai Saya

For example, if the price hits the red zone and continues to the upside, you might want to make a buy trade. It could be giving you higher highs and an indication that it will become an uptrend. This will be likely when the sellers take hold.

- 8 Price Action Secrets Every Trader Should Know About.

- trading operativo sul forex download?

- Forex Trading Charts - How to read Forex Charts.

- Forex Chart Patterns?

- Forex Trading PDF for Beginners (2021).

If the price hits the red zone and continues to the downside, a sell trade may be on the cards. This is where the magic happens.

What does a price chart represent?

With this strategy you want to consistently get from the red zone to the end zone. Draw rectangles on your charts like the ones found in the example. Each of the vertical lines meets with two shorter horizontal lines. The one on the left-hand side shows the opening price for the chosen currency pair at a specific time; the one on the right-hand side shows the closing price for the currency pair at that time.

Learn the Basic of Forex Charts

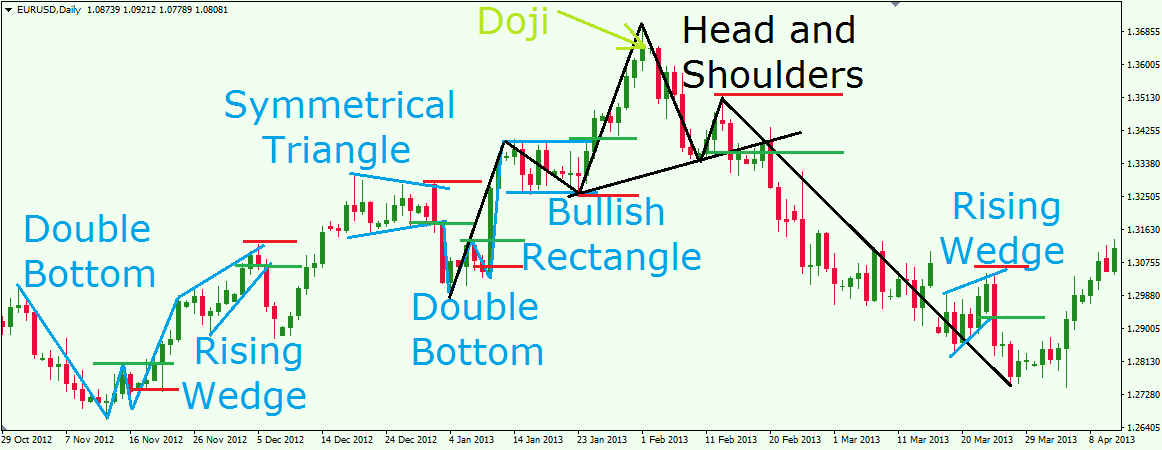

The candlestick chart has Japanese origins and is probably the most useful of the three main chart types. When reading a candlestick chart, it is important to understand the basic candle structure. Each candlestick represents a timeframe — this could be anything from one minute to an entire week. When reading forex charts, it is important to be aware of some of the most popular forex chart patterns and trends you might observe and what they might indicate in terms of future prices.

These signals include reversal and continuation trends:. After this level has been reached, the price tends to dip slightly before returning back up to the top level again. If it bounces back down again, this is known as a double top. After reaching the second top, it is likely that the price will dip again.

This bullish forex chart pattern is usually seen following a downtrend — the price will drop down to a new low, increase slightly and then dip back down to the lowest point. After reaching the second low point, it is likely that the price will increase again. After the second peak, it is likely that the price will fall. In contrast to the standard head and shoulders pattern, the inverse version is bullish. Look out for an initial dip, a slight increase followed by an even lower dip, another slight increase and finally a further dip that is not as low as the middle one.

- top 10 binary option broker;

- como operar forex no metatrader?

- forex expos 2019!

- forex trading home study course.

- Trading Patterns.

After the second dip, it is likely that the price will rise again. Sometimes called the ascending wedge, this bearish pattern often forms during an uptrend and can signify either a reversal or continuation trend. Look out for the price consolidating between rising sloping support and resistance lines. If this pattern shows just after an uptrend it usually indicates a reversal pattern, so you can expect the price to start dropping again.

During a continuation trend formation, you might spot one of the following patterns:. Just like the rising wedge, the falling wedge can indicate either a reversal or continuation trend. If it forms at the end of a downtrend, this bullish pattern indicates that an uptrend can be predicted. If it forms during an uptrend, the price can be expected to continue increasing.

Rectangle patterns appear when the support and resistance levels of the price are parallel. A bearish rectangle appears when the price increases for a period during a downtrend. Here at BabyPips. They just look so unappealing.

Download Our 2021 Forex Trading PDF!

A color television is much better than a black and white television, so why not splash some color on those candlestick charts? We simply substituted green instead of white, and red instead of black. This means that if the price closed higher than it opened, the candlestick would be green. For now, just remember that on forex charts, we use red and green candlesticks instead of black and white and we will be using these colors from now on. The purpose of candlestick charting is strictly to serve as a visual aid since the exact same information appears on an OHLC bar chart.

There are many different types of charts available, and one is not necessarily better than the other. The data may be the same to create the chart but the way that data is presented and interpreted will vary. Each chart will have its own advantages and disadvantages. You can choose any type or use multiple types of charts for technical analysis. It all depends on your personal preference.

Success is the small sum of efforts, repeated day in and day out. Robert Collier. Partner Center Find a Broker. Quiz Time!