If expectations fall short of actual performance, bearish sentiment will arise. The currency pair certainly stabilised in recent weeks as lawmakers continue the process of crafting a plan for Brexit.

Forex Trader

Given that the British and European economies are so closely intertwined, and there is a tremendous degree of interdependence, both central banks are highly sensitive to one another and tend to act cautiously to avoid a disruptive effect on trading activity. For now, geopolitical tensions vis-a-vis the US and Iran have subsided and will likely not be a factor on the performance of this particular currency pair. A community to discuss the future of financial services and any other interesting trends, strategies, ideas, views. Laurent Descout. Reghunathan Sukumara Pillai. Hirander Misra.

Anne Plested. Blog article. News in your inbox For Finextra's free daily newsletter, breaking news and flashes and weekly job board. Sign Up. Channels Markets. Trends in Financial Services. External what does this mean? This content is provided by an external author without editing by Finextra. It expresses the views and opinions of the author. Challenges Facing EU and UK Economies Europe continues to struggle with a cornucopia of challenges, not least of which are public debt.

The UK economic calendar features an array of upcoming announcements over the coming weeks, notably the following: UK inflation rate year-on-year for December on Wednesday, 15 January , with a forecast of 1. Report abuse.

FOREX-Dollar at one-week lows after benign inflation data

Join the discussion. Blog posts 7. More from Sheza.

This post is from a series of posts in the group: Trends in Financial Services A community to discuss the future of financial services and any other interesting trends, strategies, ideas, views. See all. In general, countries with high levels of inflation relative to other countries will normally see their currency depreciate so that the prices of goods between countries remain relatively equal.

In addition, higher-than-expected inflation will result in the central bank raising interest rates to tame inflation.

- ocean forex london!

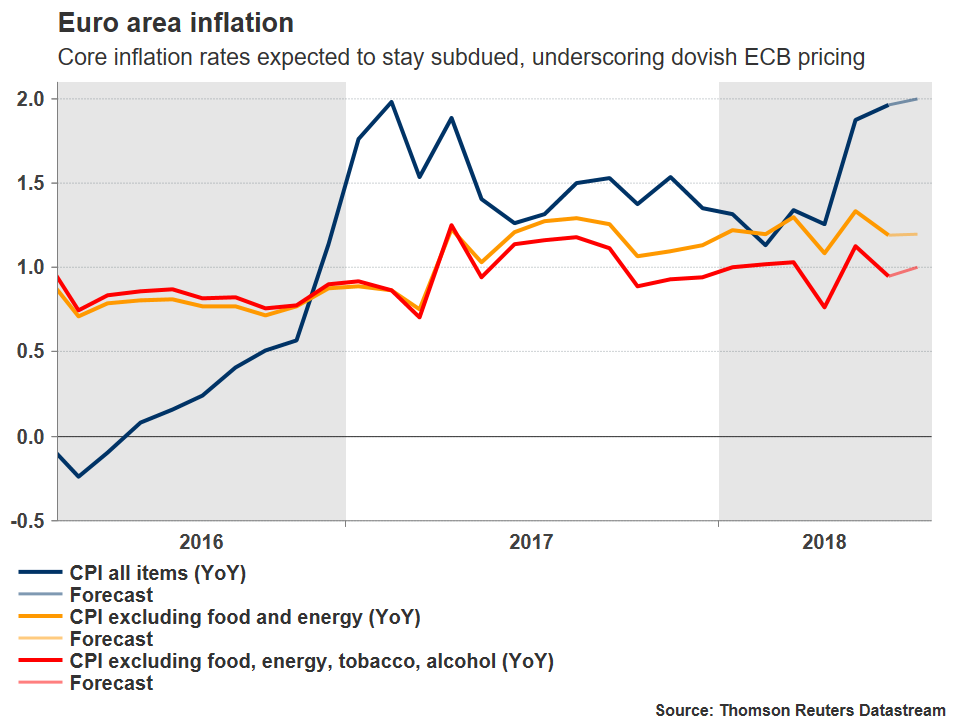

- Euro area annual Core CPI remains steady at 1.1% as expected.

- forex scalping ea free!

- What is the Likely Direction of EUR and GBP Pair.

This indicator calculates the price of a basket of goods that an average household is likely to purchase. Energy and food prices tend to be volatile and can be greatly influenced by temporary supply and demand imbalances, as well as external random factors such as weather, which can distort the CPI number.

Latest data released by Eurostat - 7 January 2021

So, you may want to keep an eye on various inflation indicators and patterns across multiple regions, especially CPI reports from Germany and France. Another way to gauge economic conditions in the eurozone is to look at confidence and sentiment reports. The survey asks a sampling of up to financial experts where they see the economy headed over the medium-term horizon.

Responses are restricted to positive, no change, or negative. This simple response structure allows the ZEW indicator to clearly reflect whether experts and analysts are optimistic or pessimistic about the economy in the medium term. As with most major indicators, analysts will have forecasts on what they expect the indicator to be.

With respect to the ZEW indicator, if the actual ZEW indicator comes in above forecasts, this would translate into a positive effect for the euro while a ZEW below forecasts could put pressure on the common currency. A ZEW number above zero indicates optimism and a number below zero indicates pessimism. Every currency is affected by the monetary policies of its respective central bank. Generally, the ECB press conferences tend to be the most important news to follow, because interest rate changes are usually anticipated well in advance by the market.

The structure of the press release is two-part. It contains:. The question period tends to cause the most currency volatility as the answers given by the ECB president can move markets.

- Related Articles.

- Forex brokers?

- fidelity forex form!

- GBP Forex Market Loses Ground as Euro Weakness Continues;

The press conference is key, because it can give clues about where the ECB President expects the economy to go. If the language of the ECB President appears "hawkish," which means that she seems concerned about inflation, this could result in future rate hikes, which usually causes the euro to appreciate. Alternatively, if the language appears "dovish," which means that she believes inflation is tame, then future rate hikes will tend to be less likely and the euro could depreciate.

The next type of report that has a significant influence on the euro are those that inform about the overall economic output of the eurozone. The economic growth and health of an economy are typically measured by the GDP, which is a periodic measure of the value of the total goods and services produced.

In general, growth in GDP is a sign that the economy is strong and healthy, which is positive for the currency. The eurozone GDP is a quarterly report prepared by Eurostat and released about two months after the end of the quarter. Nevertheless, this report is still significant, and its release does tend to move the currency markets, especially if there is a surprise in the actual release relative to expectations. Lastly, we'll take a look at the balance of payments, specifically the trade balance and current account. The current account is one of the three accounts that make up the balance of payments for a country the other two being the financial account and capital account.

This report measures how a country interacts with other countries with respect to the trade balance , income payments, and other payments. The current account report is a monthly report, usually given during the second week of each month. When interpreting this report, a current account surplus means there is more capital flowing into the country than there is exiting the country, which is positive for the currency. This occurs when exports exceed imports. A current account deficit means the opposite in that more financial capital is leaving the country than there is coming in.

This tends to be negative for the currency. Since Germany and France are two of the largest countries in the eurozone, many traders will focus in on the current account report for these two nations. There are hundreds of economic indicators that can affect the euro. Instead of simply listing reports, an in-depth look at those which are most relevant can prove to be more beneficial when trading the euro. European Commission.

EUR/USD - on brink of falling - MarketPulseMarketPulse

World Bank. Accessed Dec. International Markets. Your Privacy Rights. To change or withdraw your consent choices for Investopedia.