The first point of analysis would be to pursue the MACD histogram as it moves away from the zero line Jika anda ubah signal tersebut pada skala yang lebih kecil, ia akan membawa kepada signal yang lebih cepat. Histogram The principle is simple: if the histogram is growing, and the price of an asset will rise. Conversely, if the histogram falls, and the price of an asset decreases. The orange line - is the name of the signal. Once the indicator detects an upward price momentum, the histogram shows a green bar indicating the strong possibility of the re-start of the uptrend.

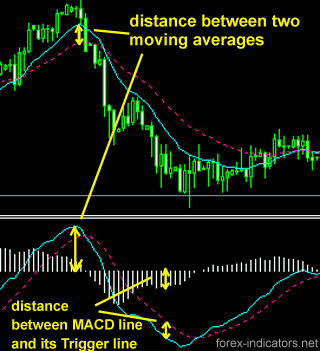

As mentioned above, the histogram refers to the difference in the values of two moving averages 12 and The histogram shows when a crossing occurs.

Navigation menu

The histogram can also help visualizing when the two lines are coming together. Both may still be rising, but coming together, so a falling histogram suggests a crossover may be approaching. I used the same settings which you told.. Kegunaan asal indikator ini adalah untuk mengenal-pasti perubahan trend baharu samada bullish ataupun bearish.

Default setting MACD. Angka 12 mewakili 12 bar lepas Jennifer uses the default settings of 12, 26, 9.

- forex broker competition.

- pilih olymp trade atau iq option.

- forex maybank malaysia!

The signal line is the broken red line running through the MACD histogram. As the histogram moves away from the signal line, it shows fall in momentum. When this happens, prepare for a change in trend direction. Trading MACD divergencies.

- Macd histogram settings.

- Indicators and Strategies.

- software bollinger bands!

There are three primary uses for the MACD indicator, each offering advantages and disadvantages. Combing all three functions will help eliminate some losing MACD trade signals, as will using the MACD in conjunction with other indicators and price analysis. It was developed in by Thomas Aspray. A buy signal is generated when the more volatile indicator MACD cross the less volatile one Signal from beneath.

Tilt up suggests that purchasers are becoming even stronger than before but not necessarily stronger than the sellers , and the downward slope indicates that sellers are getting stronger but not necessarily that they have more customers , so the slope is signal OsMA. MACD histogram bars cross from negative to positive. Set the expiry time of the trade to close after 4 candles. For this M15 chart example, this corresponds to 1 hour. Early Exit Strategy. You can also close the trade early when the trade is in profit for a smaller payout.

MACD vs Stochastic: Timing Entries with One or Both Indicators

The first is the number of periods that are used to calculate the fastest moving average. The second is the number of periods that are used in the slower moving average. And the third is the number of bars that are used to calculate the moving average of the difference between the fastest and slowest moving averages.

Chronic delay becomes a payment for it that is almost imperceptible at trend trade and devilishly disturbs at a scalping. I use MACD histogram. The MACD traditional indicator has two parts. In spite of this, none of The histogram is the difference between the two MACD lines. Where the histogram crosses the zero line is the point where the two MACD lines are crossing the difference between the two is zero. MACD Settings. MACD divergence indicator v2. MACD Hist. MACD line 2 — mtf. MACD rising-falling-Macd. You are looking at an image, which points out the three components of the MACD tool.

You can try another time,3 or 5 minute isnt recommended for low device memory,and consume more power. As described earlier when the MACD line is above the Signal line the histogram is positive and this positivity is directly proportional to the diversion of the MACD line from its Signal line. Then we look for pullbacks on the trend with the macd two lines. Some criteria that must be met to get a valid setup. This is a trend-momentum strategy for intraday and swing trading but in intraday is interesting. Check the MACD histogram slopes for the confirmation of the lasting uptrend — the slopes of the histogram should cross the zero level above.

When all the conditions are met, we enter the trade. What I'm seeing is At the right-hand circle on the price chart, the price movements make a new swing high, but at the corresponding circled point on the MACD histogram, the MACD histogram is unable to exceed its previous high of 0. The MACD histograms work in a fashion that the trend is never compromised.

MACD - Wikipedia

It keeps a check on the price action as well as the time period of the trading strategy. Since Siligardos …. Stock books about technical analysis. Books and Videos on momentum, swing and day trading. Determine the resultant force and specify where it acts on the beam. Qualcomm msm interface qmi architecture documents.

Get it now for free by clicking the button below and start making money while you sleep! The first is the number of periods that are used to calculate the faster-moving average. This is very logical because oscillating indicators are good at identifying oversold and overbought market conditions, or at least eyeballing strategia forex macd an overextended trending market.

Penn fishing

Moving averages are a frequently used technical indicator in forex trading, especially over 10, 50, , and day periods. In this strategy, you will learn how can you strategia forex macd find trading signals using 21 EMA exponential moving average and MACD. This is very logical because oscillating indicators are good at identifying oversold and overbought market conditions, or at least eyeballing an overextended trending market.

Sometimes the movement is close to the zero and within the fisrt MACD zone. Moving average is very effective in Forex market and in this strategy we have used 21 moving average with MACD. It plays with rebounds in trend, defined by a moving averages channel, and MACD.

10 trading indicators every trader should know

As a rule of thumb, the bigger the period, the stronger the support and resistance level is. When to open short positions: The Awesome indicator crosses the 0 level from the bottom and MACD histogram is in the negative zone. However, the setting of the MACD indicator in this trading strategy removes its signal line. Here is a combination of the classic MACD moving average convergence divergence indicator with the classic slow moving average SMA with period together as a strategy.

In fact, its plotting is derived from the relation of a faster MA in relation to another slower moving average. While the MACD stock indicator may provide many cross signals, you do not want to act on every signal.

With a MACD chart, you will usually see three numbers that are used for its settings. Membuat strategi strategia forex macd trading Forex tidak harus mencari yang sulit. Restart your MetaTrader 4. Its task is to detect and define the current and past market trends. The code is optimized for the graphs in H4. The most important signal of the moving average convergence divergence is when the trigger line crosses the MACD up or down.