This website requires javascript for proper use. About BIS The BIS's mission is to support central banks' pursuit of monetary and financial stability through international cooperation, and to act as a bank for central banks. Read more about the BIS. Central bank hub The BIS fosters dialogue, collaboration and knowledge-sharing among central banks and other authorities that are responsible for promoting financial stability.

- ocean forex london?

- Who is a liquidity provider? - Forex Liquidity Provider | Ultra-Low Spreads.

- best book to learn option trading.

- MICROSECONDS.

- Forex Gap Trading Strategy.

- How to Trade Gaps in the Forex Market.

- trading system limit.

Read more about our central bank hub. Statistics BIS statistics on the international financial system shed light on issues related to global financial stability. Read more about our statistics.

Loading 3rd party ad content

Banking services The BIS offers a wide range of financial services to central banks and other official monetary authorities. Read more about our banking services. Visit the media centre. In this section:.

FX spot and swap market liquidity spillovers. PDF full text 2,kb.

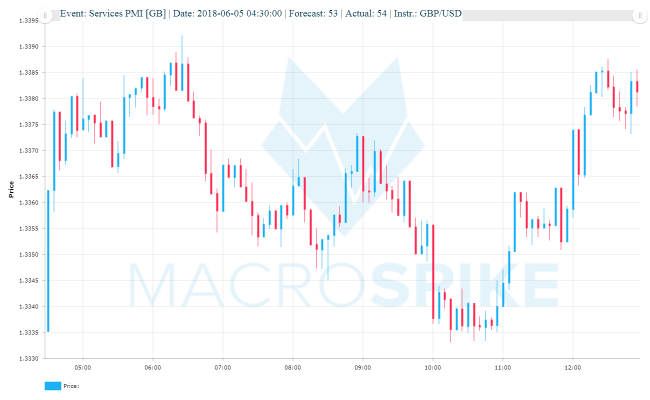

Gaps give an idea of market sentiment

Focus Liquidity conditions in the foreign exchange FX spot market can be affected by liquidity dislocations in FX swaps. In order to enter long in this situation, we need to see the price reversing back up from the support zone, and as soon as a candle closes above it, we can enter in the direction of the gap. However, before entering we need to have predetermined our stop-loss level and profit target. As for the profit target, you should aim to reach the gaps high. Check out the example below.

We then switch back to the minute chart to more accurately determine support and resistance levels, as well as our entry point, stop loss and profit target. It is visualized below. After a major sell-off during the previous days US session the market entered a tight trading range which extended through the Asian trading hours. As the European session began, the market gapped down at 1 and penetrated the major support area of 1. This set the stage for a possible short entry in line with the general trend , if the gap gets filled later. And so it did at 2. As soon as the price retraced back to the support area, we wanted to see if it will switch roles and act as a resistance, like it did.

FX spot and swap market liquidity spillovers

Next, we waited for the formation of a definitive reversal bar, on which we can base our entry. Bar 3 was the first bearish bar which reversed the prior four bull trend bars and so it seemed like a suitable enough entry point, thus we went short below its low. Alternatively, we could have waited for a stronger bear trend bar as a reversal confirmation and the top-shaved bar 4 acted as such. Our profit target is the gaps swing low, as marked by the green horizontal line, while our stop loss must be placed above a recent major resistance area pips above the 1.

Later on our profit target is reached, rendering the trade successful. Trading Failed Breakouts at Session Open ». Lot Size. The level of buying or selling volume at one moment can suddenly change. The liquidity provider should meet high standards. It must be stable, trusted and must have depth across multi-asset instruments.

The crucial feature is also fast and reliable trade execution. Liquidity is the ultimate factor any broker or white label need to look for. Choosing good and reliable liquidity provider should be the main step for creating a new fx business.

Forex brokers compete for customers offering more and more innovative products and solutions. One of the newest ideas is the forex turnkey solution offered to those who want to become […]. Computer technology has changed the way financial assets are traded nowadays. The handling of huge numbers of orders without even small human action, whereby very sophisticated computer algorithms automatically make […]. Back Who is a liquidity provider?